The labor market is rocky, costs are climbing, and uncertainty hangs over the economy. Yet consumers and businesses are showing few signs of strain — at least according to some of Wall Street’s biggest banks.

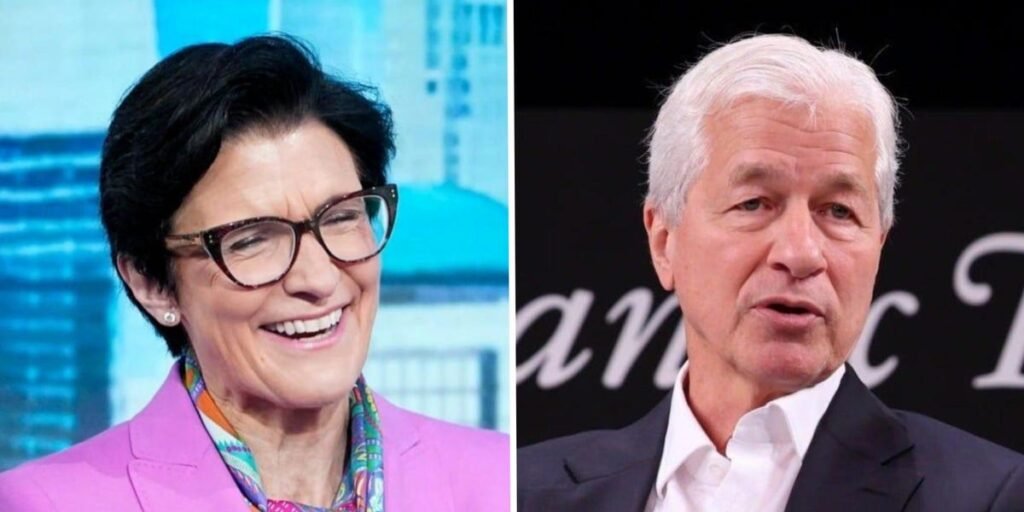

Bank earnings season kicked off Tuesday with JPMorgan Chase and Citi reporting strong consumer spending and borrowing, and unexpected jumps in fees tied to M&A and other investment banking activity.

“We continue to struggle to see signs of weakness,” JPMorgan’s chief financial officer, Jeremy Barnum, said in response to an analyst’s question. The consumer “basically seems to be fine,” he told the analyst, who asked about consumer spending and whether the bank had any reason to be more “concerned today versus three or six months ago.”

The comments suggest that American households — even amid stubborn inflation and higher borrowing costs — are still swiping, spending, and managing their finances, in many cases more than expected.

Businesses are also showing signs of resilience. Both JPMorgan and Citi also said investment banking activity rebounded last quarter as companies decided to ignore tariff uncertainty and move ahead with mergers, acquisitions, or capital raising.

In one potential sign of consumer strength, JPMorgan said it’s seen “positive early reactions” to the costly refresh of its marquee Chase Sapphire Reserve credit card, which now costs $795, up from $550.

JPMorgan CEO Jamie Dimon acknowledged that some people were taken aback by the cost hike, but said many are continuing to fork over the hefty annual fee.

“I’ve got a lot of comments from people, from friends of my kids,” he said, adding that some people have said they are keeping it for what he called “value-added” benefits like access to the Chase Sapphire lounge at the La Guardia airport in New York City.

Inflation remains a factor

At JPMorgan, revenue in the Consumer and Community Banking division rose 6% year-over-year to $18.8 billion, while net income increased 23% to nearly $5.2 billion. Spending on credit and debit cards increased 7% from a year earlier, and average loans across the consumer segment ticked up 1%. Charge-offs on card loans, a key measure of borrower stress, held relatively steady at 3.4%.

Citigroup reported an 11% increase in branded cards revenue, and said average card loans rose 5% in the quarter to $114 billion. Spending volumes increased 4% from the year before to $136 billion. Retail banking revenue also jumped, helped by higher deposit spreads, the firm said.

“We saw good growth in branded cards while retail banking benefited from higher deposit spreads,” CEO Jane Fraser said. She expressed a positive outlook for Citi’s core consumer business.

The data follows signs of an improving job market in June, even as tech giants and other large companies slash jobs in an effort to cut costs, and the Trump administration warns of looming cuts to government jobs

Inflation ticked higher in June, rising to 2.7% from 2.4% the month before, according to new government data released Monday by the Bureau of Labor Statistics. It’s the second straight month prices have accelerated, with increases seen in food, clothing, rent, and furniture.

The bump was partly blamed on new tariffs, and it may give the Federal Reserve pause as it weighs whether to cut interest rates later this year. For now, markets are dialing back expectations for a rate cut in July or September, analysts said in reactions to the data. One analyst predicted the full impact of Trump’s tariffs wouldn’t materialize in inflationary data till later this summer.

JPMorgan’s investment banking fees rose 7%, driven by gains in debt underwriting and advisory work. Citi reported a 13% jump in fees, led by equity capital markets and advisory — two areas that have struggled since the Fed’s rate-hiking cycle cooled dealmaking in 2022 and 2023.

Read the full article here