A Brazilian startup fund is betting that AI has made large headcounts and funding rounds unnecessary to compete on the global stage.Shiva, named for the Hindu god of transformation, has…

2026-03-09T18:42:55.512Z Share Copy link Email Facebook WhatsApp X LinkedIn Bluesky Threads lighning bolt icon An icon in the shape of a lightning bolt. Impact Link Save Saved Read in app…

Key takeaways Buying a second home will effectively double your housing expenses, so consider your overall financial picture carefully first. If you plan to rent out the home to offset some of the cost, be sure to research local regulations…

Passengers traveling through Houston, New Orleans, Chicago, and other US airports experienced hourslong delays on Sunday and Monday as spring break travel peaked and the Transportation Security Administration experienced staffing shortages due to the ongoing partial government shutdown.Nearly 2.8 million…

Seven years ago, I started making my own sourdough bread.In addition to being a relaxing hobby that’s taught me the importance of patience, making bread also keeps me from spending ridiculous amounts of money on loaves from the grocery store.However,…

You might think a military conflict halfway across the globe has nothing to do with the price of your breakfast cereal. I’m here to tell you that’s a dangerous illusion. Global supply chains are fragile, and the ongoing situation with Iran is already sending shockwaves through the commodities market. When…

It’s a question I hear every time a geopolitical crisis hits the news. If the United States is the undisputed heavyweight champion of crude oil production, why do our gas prices skyrocket the second trouble brews in the Middle East? Right now, we’re watching the conflict with Iran push oil…

Key takeaways Interest can be charged when you borrow money or earned when you save. When you charge something on a credit card or take out a loan from a…

Most parents think that using AI for schoolwork is unethical. Most kids and teens think it should actually be encouraged. Loading audio narration… That’s just one place where parents and…

2026-03-09T17:29:06.336Z Share Copy link Email Facebook WhatsApp X LinkedIn Bluesky Threads lighning bolt icon An icon in the shape of a lightning bolt. Impact Link Save Saved Read in app This story is available exclusively to Business Insider subscribers. Become…

fizkes / Shutterstock.comDo you have what it takes to make every employer fight for you? Not sure? Don’t worry. You’re about to learn what some of the most desirable employability skills are. We’ll also show you how to improve them…

Jonathan Weiss / Shutterstock.comAre you really getting the most out of your Costco membership? You may think you are if you’ve figured out how to save money on groceries by buying everything you need in bulk — even wine. You…

Anthropic has filed suit to block the Pentagon’s effective blacklisting of the company and its products. Loading audio narration… On Monday, Anthropic sued the Department of Defense, the Executive Office of the President, Defense Secretary Pete Hegseth, and several other…

Finance Newsletter

Subscribe for News and Alerts

Get the latest Finance, business, and many more news and tips directly to your inbox, join our newsletter now to stay updated.

Finance

View MoreSaul Van Beurden has a folder on his phone labeled “productivity.” He’s constantly consulting the many AI apps that live there, whether sitting in his 60th-floor office in Hudson Yards or in front of his broken laundry machine.Van Beurden, who…

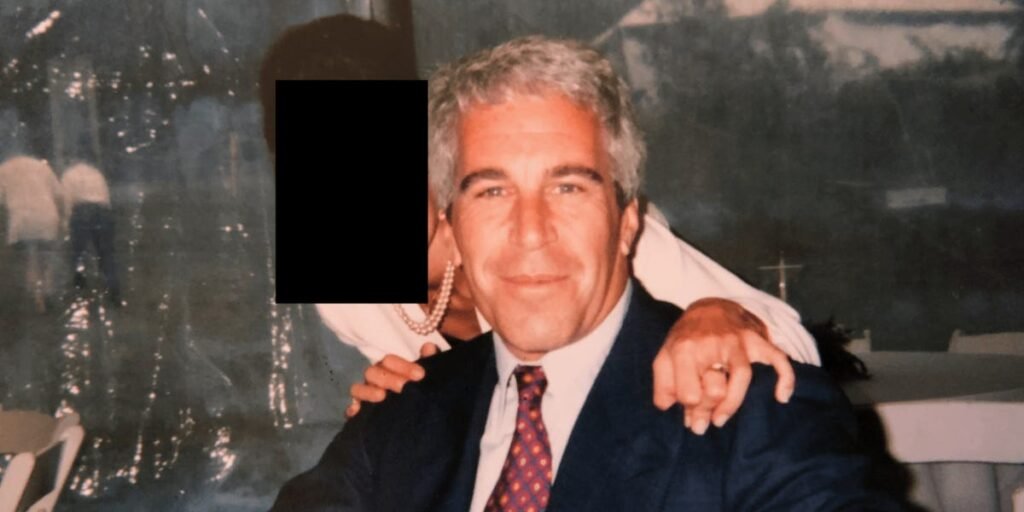

In the seven-year debate over Jeffrey Epstein’s death, one important voice has been missing: the doctor who performed his autopsy.Epstein was found dead in his…

I’m in my 50s, and my brain fog scares me. Now I’m doing everything I can to give my memory a boost.

“I forgot your sister asleep in the car,” I shouted to my 6-year-old son as I bolted from the tennis court and waded through the…

Business & Startup

View MoreCafé L’Europe, one of the oldest buildings in St. Armands Circle, in Sarasota, Florida, has been flooded four times in the past 18 months. “That last one from Helene completely wiped out the restaurant. Every piece of equipment is ruined……

Lowe’s plans to provide millions in financial support to small businesses in North Carolina that were hit hard by Hurricane Helene, helping them recover during…

The Prince George’s County council in the state of Maryland recently voted 10-0 in favor of enacting a measure limiting how densely convenience stores can…

Markets

View MoreAfter a two-week trip in 2015, my husband and I came home completely hooked on Japan. Loading audio narration… Reliability was the baseline; trains ran with a clockwork precision that transformed the daily commute into an exercise in discovery. We…

AI’s infusion in businesses means a reconsideration of the traditional org chart, writes BI’s Lakshmi Varanasi.The “Great Flattening” is still all the rage, but the…

When the economy is uncertain, CEOs often reach for a familiar lever: job cuts.And things are feeling far from certain these days.January layoffs were the…

Investing

View MoreLatest News

View MoreRecently, a home in the beautiful Forest Hill neighborhood of San Francisco was listed for $2.4 million. It had four bedrooms, three bathrooms, and a modest 2,250 square feet. The home had been remodeled about 15 years earlier and was…

When successful businessman Mike Black walked away from his wealth in 2020, his goal was incredibly ambitious. He voluntarily froze access to his money, temporarily stepped away from his lucrative network, and set out to live on the street in…

Hindsight costs nothing, but in retirement, it can feel like it costs everything. A handful of decisions made years earlier determine whether your later years offer comfort or constant financial stress. When researchers ask retirees what they would do differently,…

In April 2024, Brandon Upchurch and his cousin were driving home from a convenience store when they noticed flashing lights behind them. When Upchurch pulled over, officers from the Toledo Police Department drew their guns and ordered him out of…

Trade jobs like plumbing are supposed to be among the hardest for AI to replace. Loading audio narration… For Ania Smith, the CEO of Taskrabbit, that’s good news.Taskrabbit, founded in 2008 by Leah Solivan, is a platform where gig workers…

There’s something going on at Steak ‘n Shake lately. It’s put up giant American flags and axed microwaves. Its pinned tweet is a picture of Health and Human Services Secretary Robert F. Kennedy Jr. Judging by the fast-food chain’s social…

When McDonald’s CEO Chris Kempczinski posted a taste test of the chain’s new Big Arch burger, the internet had notes. Loading audio narration… Viewers mocked his buttoned-up delivery, his modest mouthful, and zeroed in on one word in particular: his…

Florida oranges are harder to come by after recent hurricanes impacted production at farms across the state. The U.S. Department of Agriculture predicts the state’s citrus season, which runs from October to June on average, will be worse than last…

The anticipation of Donald Trump returning to the White House sparked a surge of optimism on Main Street, according to multiple post-election surveys. The National Federation of Independent Business’ (NFIB) latest Small Business Optimism Index jumped 8 points to 101.7…

Coach’s former CEO said Gen Z reminds him of his generation.Speaking to Bloomberg in an interview released on Sunday, ex-CEO Lew Frankfort said he started at the New York City-based luxury company 45 years ago.”So I’ve seen generations change, and…

Most Popular

America’s small business owners are feeling better about the economy than they have in six years, in anticipation of President-elect Trump returning to the White House. The National Federation of…

AI’s biggest impact will likely happen far from laptops, says the CEO of a $15 billion AI company.Qasar Younis, the cofounder and CEO of Applied Intuition, said on an episode…

This as-told-to essay is based on a conversation with Victor Chan, a 73-year-old living in Singapore. It has been edited for length and clarity. Loading audio narration… Health is wealth,…

As consumers around the U.S. have eased into 2025 with a month-long commitment to refrain from alcoholic beverages, some are contemplating keeping a lack of spirits alive in February and…

2026-03-09T04:01:20.606Z Share Copy link Email Facebook WhatsApp X LinkedIn Bluesky Threads lighning bolt icon An icon in the shape of a lightning bolt. Impact Link Save Saved Read in app…

A Long Island-based liquor brand drew inspiration from a 1975 crime-ridden New York City to introduce consumers to a dark and gritty yet refined product that was unique among spirits. In a propaganda campaign, plainclothes New York law enforcement officers approached tourists with pamphlets…