- Vistra reported earnings Thursday, and its stock fell 11% that day as of publication time.

- The energy company is in talks with data centers on powering the facilities with its nuclear fleet.

- Investors want to see a deal signed. The CEO said regulatory hurdles are holding up the process.

The AI boom has led to a massive demand for energy to power data centers. At the same time, red tape is slowing dealmaking between data centers and power providers, Vistra CEO and president Jim Burke said on Thursday’s fourth-quarter earnings call.

The Texas-based energy company released fourth-quarter results on Thursday that topped expectations. Still, shares of the company’s stock had declined over 11% that day by the time of publication, wiping out gains made in the last 24 hours.

Vistra is one of several independent power providers that saw its stock surge in the last year as Wall Street hyped up companies it sees as well-positioned to benefit from the AI boom. The company’s drop in share price mirrored that of chip maker Nvidia, which saw its share prices fall despite beating analyst expectations in its earnings Wednesday. This demonstrates how companies like Vistra are intertwined with the fate of AI.

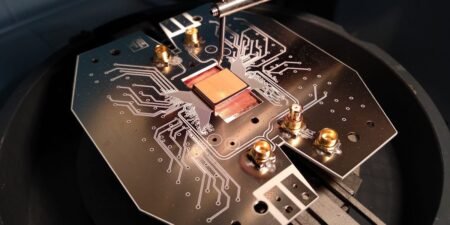

Vistra acquired four nuclear power plants in March 2024 through its $3.4 billion acquisition of retail electricity provider Energy Harbor. Located in Ohio, Pennsylvania, and Texas, the plants have a combined generation capacity of four gigawatts—enough energy to power 3.2 million homes.

The company has not yet announced a deal to power a major data center with one of those nuclear plants, even though Vistra has indicated to investors in the last year that the additional capacity positions the company to take advantage of surging electricity demand from data centers. Vistra has signed power purchase agreements with Amazon and Microsoft for its solar facilities in Illinois and Texas.

“Because it’s fairly complicated, it’s elevated to discussion in all regulatory and policymaking circles,” Burke said in response to an analyst who asked when Vistra would announce a contract had been signed.

Vistra looks to power more data centers

Vistra has two options for contracting with major data center customers: a power-purchase agreement or a co-location arrangement. Both come with significant hurdles. The first, signing a long-term power-purchase agreement, would involve a data center customer agreeing to buy power from one of Vistra’s plants for up to 20 years, similar to Microsoft’s deal to restart the Three Mile Island nuclear plant.

The other option is co-location, where a data center customer would build or buy an existing data center on-site, as Amazon has agreed to do in its deal to buy power from Talen Energy’s Susquehanna nuclear plant in Pennsylvania.

“When you think about that, because it’s a new concept, there’s a lot of terms and conditions, including the risk sharing that goes into that partnership because you’re making a 10, 15, 20-year commitment, said Burke. “And you see, not many deals have been announced that have actually been co-location related.”

Burke said Vistra is involved in discussions with “all the major hyperscalers” and data center developers.

“We feel good about the direction of travel on it, but it’s still something that we’ve got to actually get over the finish line before you’d see us announce something,” Burke said. “The timing of an announcement will also be dependent at some level on when we get clarity on how these deals can move through the process. “

Vistra reported $2.8 billion in net income in the 2024 fiscal year, including $490 million in the fourth quarter, up from $1.49 billion in net income in the 2023 fiscal year and a loss of $184 million in the fourth quarter of that year.

Energy companies face deal hurdles

Many co-location deals—in particular, Amazon’s deal with energy firm Talen—have been mired in significant red tape.

In January, Talen filed a petition appealing a decision made in November by the Federal Energy Regulatory Commission to reject its interconnection service agreement with Amazon. FERC rejected to approve the agreement on the grounds that making Amazon the sole recipient of power generated by the Susquehanna plant, which currently serves power to the local electric grid, could threaten grid reliability and national security.

In Texas, state legislators are discussing a bill that would require energy companies with co-location deals to generate additional power for the local grid.

Do you have a story to share about data centers and energy? Contact this reporter at ethomas@businessinsider.com.

Read the full article here