America’s central bank is once again holding interest rates steady, although two Fed governors disagreed with the move in a rare departure from the committee’s typical unanimity.

The Federal Open Market Committee announced Wednesday that it will not cut its benchmark rate, holding for the fifth time this year. It’s a decision in line with forecasts: CME FedWatch, which anticipates interest-rate changes based on market moves, had projected a 96.9% chance of a hold in July. The Fed said in its July 30 statement that strong jobs numbers and a recent uptick in inflation contributed to the call.

Fed Governors Christopher Waller and Michelle W. Bowman dissented from the hold decision, saying they preferred a rate cut.

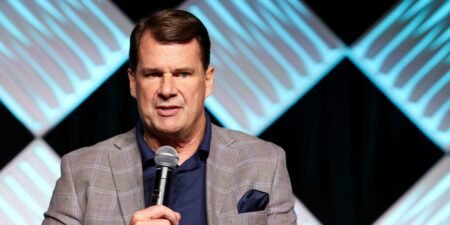

“What you want from everybody, and also from a dissenter, is a clear explanation of what you’re thinking and what your argument is, and we had that today,” Chair Jerome Powell said at the press conference. “It was a good meeting, and people really thought about this.”

Powell added that “the majority of the committee” believes that current inflation and employment markers call for “moderately restrictive policy for now.”

The chair said that the US is in a “solid position” economically, and the labor market is in balance. There’s a slowing supply of jobs and demand for workers, contributing to a historically-low unemployment rate, he said. And, while Powell said the full impact of President Donald Trump’s tariffs “remain to be seen,” he said the price of many consumer goods are rising, which is a contrast from easing inflation on service prices.

“If we cut rates too soon, maybe we didn’t finish the job with inflation. History is dotted with examples of that,” Powell said. “And if we cut too late, maybe we’re doing unnecessary damage to the labor market. We’re trying to get that timing right.”

Fed policy has gotten pushback from the Trump administration

While there’s still time for the Fed’s two penciled-in cuts in 2025, some economists and Trump administration leaders hoped for a change sooner rather than later. They’ve put the central bank — and Powell — in the hot seat.

President Donald Trump has consistently pushed for Powell to cut rates, writing in a July 8 Truth Social post that “‘Too Late’ Jerome Powell,” “has been whining like a baby about non-existent Inflation for months, and refusing to do the right thing. CUT INTEREST RATES JEROME — NOW IS THE TIME!” Trump has also suggested removing and replacing Powell before the end of his tenure next year, though Wall Street leaders and top CEOs have warned that changing the Fed’s leadership could have significant market consequences.

Trump’s cabinet members have echoed his criticisms. Treasury Secretary Scott Bessent said in an interview last week that the Fed is “fear-mongering over tariffs,” and “I think that what we need to do is examine the entire Federal Reserve institution and whether they have been successful.” Commerce Secretary Howard Lutnick added that Powell is “doing the worst job” and “I don’t know why he’s torturing America this way. Our rates should be lower.”

Waller, the dissenting Fed governor, also pushed for a rate cut ahead of Wednesday’s meeting: “With inflation near target and the upside risks to inflation limited, we should not wait until the labor market deteriorates before we cut the policy rate.”

The Fed’s play to keep rates steady is a response to key indicators of economic health. The US labor market exceeded expectations by adding 147,000 jobs in June — due mostly to growth in the healthcare and hospitality sectors — and unemployment cooled to 4.1%. Consumer sentiment and retail spending are making a small recovery from early summer dips, and GDP rose more than expected this month. Inflation climbed to 2.7% in June from 2.4% in May, moving further from the Fed’s 2% goal. Keeping rates unchanged is a strategy to curb further inflation while the Fed still sees positive momentum in the job market, Powell said.

Powell has also said that he’s watching Trump’s tariff agenda closely. The White House’s next planned tariff deadline is August 1, which could place new levies on top trade partners. The president struck a deal with the European Union earlier this week, which sets a 15% tariff on most imported European goods, a reduction from Trump’s planned 30% tariff.

The Fed chair emphasized at Wednesday’s press conference that his top priorities are to promote maximum US employment and stable prices, regardless of politics and policy.

“The credibility of the Fed on price stability is very, very important. People believe that we will bring inflation down,” he told Congress last month, adding, “That credibility once lost is very expensive to regain.”

Going forward, Powell said he is thinking about the reliability of the economic data. These concerns come as the White House’s DOGE office continues to cut staff and agency budgets across the federal government.

“The government data really is the gold standard in data,” he said. “We need it to be good and to be able to rely on it. We’re not going to able to substitute that. We’ll have to make due what what we have, but I really hope we have what we need.”

Read the full article here