On the latest episode of the Financial Samurai podcast, I sat down with Ben Miller, cofounder and CEO of Fundrise, for a deep dive into artificial intelligence, venture capital, and what it really takes to get into the best private company deals.

Ben was in San Francisco this summer visiting various portfolio companies and trying to make new investments. We also caught up over lunch in Cole Valley.

As someone with over $350,000 invested in Fundrise Venture across three accounts, I’m thrilled to speak with Ben about what he’s seeing in the AI and private company space. Since Fundrise has long been a sponsor of Financial Samurai, I’m fortunate to get regular one-on-one time with him. When you invest a significant amount of capital, it’s always wise to conduct due diligence directly with the person in charge.

I strongly believe AI will be the next major investment growth trend over the next decade. Since I won’t be joining a fast-growing AI startup, I want as much exposure to the space as I can comfortably take on. My private AI investments range from Series Seed to late stage (Series E and beyond), and I also individually own all of the Magnificent 7 companies.

The State of AI: Multiple Winners Accelerating

We started with AI’s growth trajectory. The biggest players—like Anthropic—aren’t just expanding, they’re accelerating their revenue growth.

I floated the idea that AI might eventually become commoditized. Ben disagreed, arguing that the leaders are continuing to differentiate, pulling further ahead with better products, stronger talent, and deeper moats.

It seems like with all the tremendous AI CAPEX spend, the market is big enough for multiple winners.

Venture Fund Concentration and the Power of Big Bets

We discussed how much concentration is both healthy and required in a venture fund. Regulations state that 50% of the fund must be spread across at least two companies, but within that framework, a fund can still make very concentrated bets.

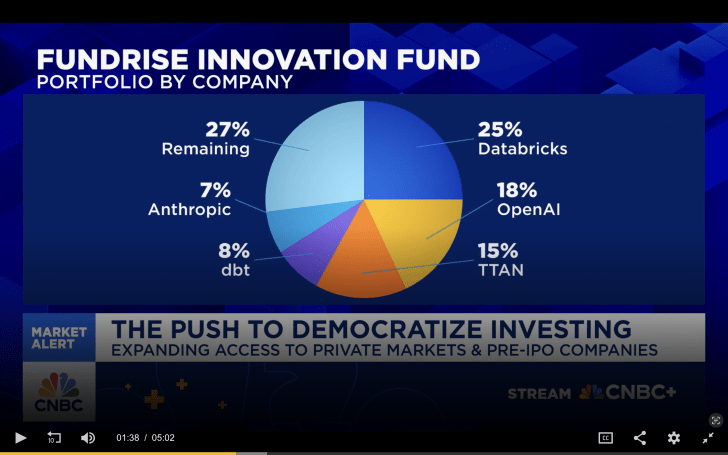

Currently, about half of the Fundrise Innovation Fund is invested in just three companies: OpenAI, Anthropic, and Databricks. This kind of focus is higher risk, but when you pick the right horses in a transformative sector like AI, the rewards can be enormous.

As the great hedge fund investor Stanley Drukenmiller said, “If you look at all the great investors that are as different as Warren Buffett, Carl Icahn, Ken Lagoon, they tend to take very, very, concentrated bets. They see something, they see it, and they bet the ranch on it. The mistake I’d say 98% of money managers and individuals make is they feel like they got to be playing in a bunch of stuff. And if you really see it, put all your eggs in one basket and then watch the basket very carefully.”

We talked about the planned evolution of the Innovation Fund’s holding composition going forward, the holding periods of these companies, and strategies for finding the next winners. The Innovation Fund also owns Canva, Vanta, dbt Labs, Ramp, Anyscale, Inspectify, and more.

Rethinking Valuation: Growth-Adjusted Metrics

Valuation came next. Ben introduced the Growth-Adjusted Revenue Multiple as a better lens for assessing fast-growing companies—similar to the price/earnings-to-growth (PEG) ratio for public stocks.

If we’re truly still in the early innings of AI, it makes more sense to value companies based on both their revenue growth and scale, rather than traditional multiples alone.

It seems like investors may be underestimating how fast AI is actually growing, based on a discussion Ben had with an investment banker at Goldman Sacs who suggested modeling a 30% growth rate instead.

We also touched on the Baumol Effect—how rising labor costs in low-productivity sectors can accelerate technology adoption. In other words, when wages rise faster than productivity, businesses have more incentive to adopt AI to close that gap.

Competing for the Best Private Growth Deals

From there, we moved to one of the toughest challenges in investing: access. In my view, trying to secure a meaningful IPO allocation in a hot deal is an exercise in futility. I’d much rather invest in promising companies before they go public.

Using the Figma IPO as an example, Ben illustrated just how difficult it is to get a substantial allocation—even for well-connected investors. Figma was a name Fundrise didn’t invest in, despite being a customer.

The Innovation Fund’s ability to invest in the top six of CNBC’s top 50 Disruptor companies is no accident. It’s the result of deliberately reverse-engineering the process to identify winners early, then finding a way in.

Fundrise’s Significant Value Proposition To Private Companies

One unique competitive advantage Fundrise has is its ability to mobilize over a million of its users to spread awareness about a portfolio company’s product. Beyond visibility, Fundrise can actively drive growth—such as promoting Ramp, a corporate card company recently valued at $22 billion. This creates a powerful loop of adoption, growth, and valuation gains that goes far beyond simply writing a check or making introductions.

Of course, having top venture capitalists on the cap table still matters. Their connections and expertise are valuable. But I especially like that Fundrise is a private company itself, often using the very products it invests in (Ramp, Inspectify, Anthropic, dbt Labs, etc). This hands-on involvement can result in deeper due diligence than traditional VCs typically perform. And when Fundrise can also help drive business to those portfolio companies, that’s an enormous value add any private company CEO would want.

For these reasons, I’m bullish on Fundrise’s ability to keep backing some of the most promising companies in the years ahead.

The Global AI Race: China vs. the U.S.

We wrapped by discussing the difference in global attitudes toward AI. China is moving forward aggressively and optimistically, while the U.S. often takes a more cautious, regulatory-heavy approach.

For me, this only reinforces the need to maintain exposure. I don’t want to look back in 20 years and wonder why I sat on the sidelines during the biggest technological shift of our lifetimes.

If you want to hear the full conversation—including deeper dives into valuation metrics, venture fund strategies, and the practical realities of competing for elite deals—you can listen to the episode below.

You can also listen by subscribing to my Apple or Spotify podcast channels. If you’re a venture capital investor, I’d love to hear from you. What are you seeing and what are some of your favorite investments?

Invest in Private Growth Companies

Companies are staying private longer, which means more gains go to early private investors rather than the public. As a result, it’s only logical to allocate a greater portion of your investment capital to private companies. If you don’t want to fight in the IPO “Hunger Games” for scraps, consider Fundrise Venture.

About 80% of the Fundrise venture portfolio is in artificial intelligence, an area I’m extremely bullish on. In 20 years, I don’t want my kids asking why I ignored AI when it was still early.

The investment minimum is just $10, compared with $100,000+ for most traditional venture funds (if you can even get in). You can also see exactly what the fund holds before you invest, and you don’t need to be an accredited investor.

Subscribe To Financial Samurai

Pick up a copy of my USA TODAY national bestseller, Millionaire Milestones: Simple Steps to Seven Figures. I’ve distilled over 30 years of financial experience to help you build more wealth than 94% of the population—and break free sooner.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise.

To Your Financial Freedom,

Sam

Read the full article here