Over the holidays, I spent more than I had intended on gifts for my family. I didn’t go into debt, but I certainly overspent my personal limit. So after Christmas, I held myself to a strict 30-day no-spending commitment in order to bounce back financially after the added holiday spending.

My goal was to only pay bills. I didn’t want to buy anything extra, but I knew things always come up, like my son needing something for school. I told myself ahead of time that I could “break the freeze” for absolute necessities only. Over the 30 days, copays for doctor’s appointments and prescription costs were the only unexpected purchases I made.

I spent the rest of the month focusing on my spending habits.

I had to first curb my late-night spending

One morning before my self-imposed freeze, I woke up and immediately regretted spending $25 on gummy bears online the night before. When I tried to cancel my order in the light of day, it was too late. My order had already shipped.

During my spending freeze, I noticed that nighttime scrolling on my phone is my least rational spending period. To mediate this, I made myself sleep on it. I forced myself to leave anything I wanted in the online cart and go to sleep. Unfailingly, by the next morning, I thought whatever I wanted the night before was silly or unnecessary.

By sleeping on it, I avoid impulse purchases I later regret, but I also see what I truly want. I started adding the handful of things I still wanted in the morning to a birthday wish list. It makes me feel like I’m still acquiring it, while also giving me something to look forward to.

I started using cash again when I’m out shopping

I rarely had cash on hand before, but during my freeze, I noticed it felt better to spend what I already had in my wallet rather than put everything on my card.

I decided to start carrying cash when grocery shopping and noticed myself seeing things for their true cash value when I was out shopping.

Steak, for instance, felt like a much bigger splurge when I had to hand over $20 to $30 for it at the register.

I decided to prioritize saving for my family

The less money I spent, the more I looked at what I had at home. I paid more attention to my family, including the pets. My oldest dog really needs a teeth cleaning, but since it costs about $700, I’ve been putting it off.

I thought about how quickly I could save up for veterinary care if I didn’t spend frivolously, like on $25 gummy bears, and realized I could do it in a month or two with careful spending.

Realizing this just made me want to spend more mindfully with my family from now on.

I’ve noticed what makes me most vulnerable to quick spending

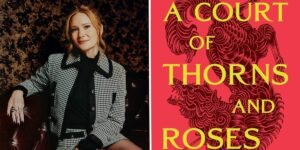

It’s most difficult for me to stop myself from buying books and T-shirts. I could never have enough of either. But what’s glaring to me now is that a book is about $10 and a T-shirt is about $25 — both bought on Amazon.

Those price points don’t feel like a lot at the moment, but a few of these purchases each month easily add up to $100.

Having recognized that these two items are my weaknesses has helped me break this habit.

The less I spent, the more grateful I became

Not letting myself buy anything new for a month made me appreciate every possession I already had more. I noticed myself taking better care of my clothes and giving certain appliances “deep cleans.”

I read some of the many books I had sitting around forever. Then, I got honest about the shows and movies we were actually watching. We cut our monthly bills by almost $100 by canceling a few streaming services.

I now view every purchase as a decision between what we really need and something we really don’t. The freeze helped me see what really matters in life, such as being proactive with my pup’s health.

When I splurge a little now, it feels more valuable somehow, especially for certain groceries. Our steak, which costs a small fortune, is somehow better because I see the true cost.

Read the full article here