Business

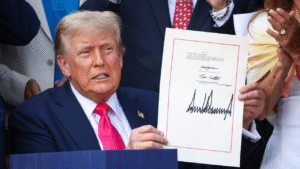

Key takeaways The One Big Beautiful Bill Act has introduced a wide range of tax cuts and adjustments that small business owners should pay attention to and prepare for. New deductions around pass-through income, tipped and overtime wage and bonus depreciation can allow small business owners and workers to lower…

Key takeaways Backed by assets, secured business lines of credit may offer more favorable rates and terms than unsecured lines of credit. Unsecured business lines may still require a personal guarantee. You can use a business line of credit to cover inventory, payroll, equipment purchases, repairs and more. Unsecured credit…

Key takeaways Grants are a great option for small businesses looking for financial support to start or expand their operations without taking on debt Federal grants, made available through different branches of the U.S. government, provide funds to small businesses across multiple industries Regional and state-level grants may offer smaller…

Key takeaways Female entrepreneurs often face more challenges than male entrepreneurs when accessing business funding Grants specifically targeting businesses owned by women can provide valuable funding State and local agencies can be another source of funding and grants for women-owned businesses The 2024 Wells Fargo Impact of Women-Owned Businesses notes…

Key takeaways A corporation is a separate legal entity that issues shares (stake in the company) to owners and protects their personal liability A partnership is owned by its partners and is easier to establish and maintain Partnerships and some corporation types are pass-through entities, which means they avoid double…

Key takeaways You can look into speedy alternatives to bank business loans in the form of loans from an online lender, invoice financing or merchant cash advances The SBA offers community-based loan programs that are lenient with approvals Bootstrapping, grants and equity financing help startups avoid debt Banks may be…

Key takeaways Read the terms of your loan carefully to ensure you manage it effectively. Ask your lender questions if you’re unsure about loan terms and conditions. Securing an LLC loan with business assets can help you get more favorable terms but makes your collateral vulnerable to seizure if you…

Key takeaways A merchant cash advance forwards cash against future sales. MCAs have aggressive repayments that disrupt profitability until it’s repaid. Borrowing fees are high with rates of 50 percent to 100 percent or more. According to the 2024 Small Business Credit Survey, business loans and lines of credit are…

Key takeaways Fast business loans are a type of financing that can provide funding often within 24 to 48 hours. Fast small business loans often come with higher interest rates and shorter repayment terms than other business loans. Fast business loans are typically offered by online lenders that often have…

Key takeaways Applying for a business startup loan can help build credit and provide access to funds to cover working capital, inventory, equipment costs and more Startup loans can also come with tax advantages and protect the owners’ personal assets from some risks, depending on the business type Startups may…