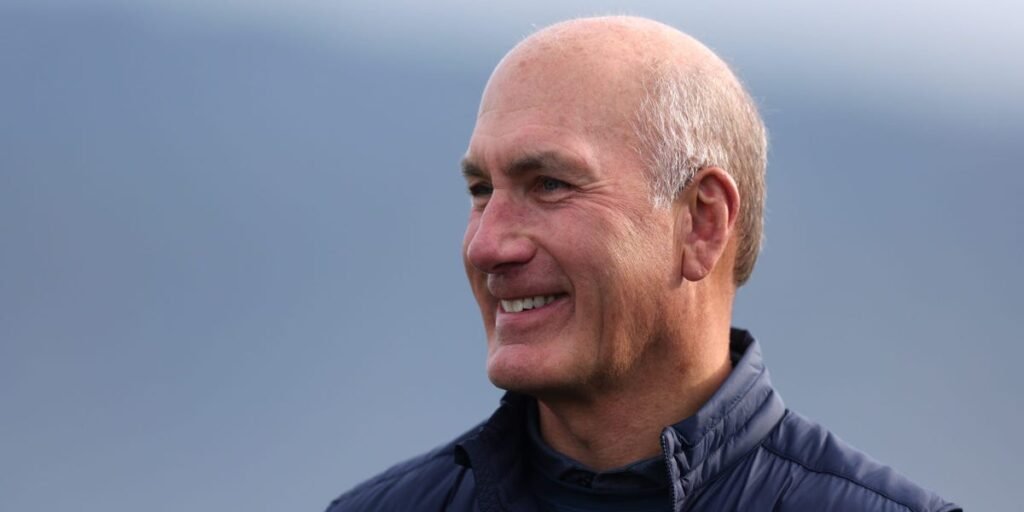

AT&T is facing a once-in-a-century challenge, and CEO John Stankey is pushing the company to “disrupt itself” and go hardcore to meet the moment.

The telecom’s sprawling network of copper wires is no longer suited to 21st-century demands for speed and mobility, demands that increasingly require new infrastructure of fiber optic networks and wireless spectrum.

Stankey, who took the helm as CEO in July 2020, knows this. He’s shown himself willing to do something about it — even if that means a sharp departure from the legacy company’s past to prepare for the future.

As the company moves to sunset most of its copper network in the US by the end of 2029, Stankey has also instituted a broad cultural shift internally. He’s moved away from prioritizing 20th-century corporate values like loyalty and tenure in favor of a tech-style, “more market-based culture,” the AT&T CEO wrote in a sweeping memo last week that was first reported by Business Insider.

It’s a strategy that is showing signs of paying off, with many Wall Street analysts recently boosting their price targets for the stock. AT&T shares are up 22% this year compared to 8.25% for T-Mobile and 6.7% for Verizon.

“They refocused on fundamentals, and the fundamentals are just getting better,” BNP Paribas telecom analyst Sam McHugh told Business Insider. “Investors really like that simple strategy. It gives a very clear message — it’s delivering financially.”

It’s a transition that Stankey says is vital to the company’s future — and will take time to accomplish.

“We are midstream on a multi-year journey to build the company we want, not simply optimize the one we have,” the CEO wrote in his memo.

“I tried to pick my brain for an example of another 100+ year old company that didn’t have to disrupt itself to secure sustainable relevance. I am still searching for the first example,” he added. “I suspect our willingness to disrupt ourselves is the under-pinning of why this company approaches 150 years of relevance.”

AT&T’s bid for continued relevance has meant the building of large and growing wireless and fiber optic networks as it looks to fend off increasing competition from Verizon, T-Mobile, and a host of smaller operators.

The company has managed to keep pace with its top competitors in terms of mobile phone accounts as it ramps up an aggressive fiber optic expansion that Stankey says will lead to further mobile signups from customers looking to bundle services.

AT&T beat expectations for its second quarter earnings, released in July, on the back of strong wireless and fiber subscriber growth and a multi-year estimated tax benefit of up to $8 billion from the One Big Beautiful Bill Act.

It could face a more challenging second half of the year.

The company said that some of the second quarter’s lift came from new customers pulling orders forward to avoid tariff-related price hikes, and that it was cautiously anticipating higher rates of customer churn in the latter half of the year.

“We are assuming that we’re going to continue to have a competitive environment,” AT&T CFO Pascal Desroches told analysts.

Another area that Stankey is reshaping is AT&T’s workforce.

Without such a massive legacy copper network to support, most of AT&T’s competitors have managed to grow with a comparatively smaller head count.

AT&T now has roughly 141,000 employees, and the company has taken several rounds of reductions in recent years to align its workforce more with its peers. Verizon has 99,000 and T-Mobile has 70,000, and Verizon also gave buyouts last year to some 4,800 workers.

The increasingly strict return-to-office mandate that AT&T has rolled out in phases over the past year has also resulted in further reductions, multiple employees have told Business Insider, and Stankey signaled in his memo that he’s fine with more people leaving if they’re not on board with the company’s new direction.

“If a self-directed, virtual, or hybrid work schedule is essential for you to manage your career aspirations and life challenges, you will have a difficult time aligning your priorities with those of the company and the culture we aim to establish,” he said in the memo.

Stankey has taken a similar my-way-or-the-highway approach in the past.

He was the company’s chief operating officer who drove the acquisition of Warner Media and reportedly led the division with a high-handedness that ruffled the entertainment executives. The move was part of a larger trend of network services providers seeking to own content producers, and Stankey (as CEO) shrugged off setbacks as he pursued a vision of expanding HBO to rival Netflix and Amazon Prime.

AT&T jettisoned Warner Media in 2022 at a loss of over $40 billion, and finalized its exit from the media business earlier this year when it sold its remaining stake in DirecTV to private equity firm TPG at a steep discount.

While Stankey’s apparent appetite for taking big bets seems unchanged, the circumstances around this chapter in the company’s history are potentially more favorable.

“I’m sure there’s a book to be written one day of how you can turn around your profile among investors,” said McHugh, the BNP Paribas telecom analyst, who said many long-term investors previously dismissed the company for its poor execution and misallocation of capital into non-core assets, like the media deals Stankey led.

“I covered European telcos for a long time. Basically, the stocks that do best in the sector are the ones who have a simple story and just focus on their core competencies,” he added. “By luck or by good judgment, I think they’re now on the right track.”

In his memo, Stankey said the workplace and technological shifts were essential for AT&T to succeed in the market, citing US Army General Eric Shinseki as saying, “If you dislike change, you’re going to dislike irrelevance even more.”

Read the full article here