- A new wave of weight loss drugs could lead to indirect effects for all kinds of companies.

- It’s also possible that people’s productivity over their lifetimes could increase, impacting the economy.

- “Better-for-you products” could be the winners of the future economy, one expert told Business Insider.

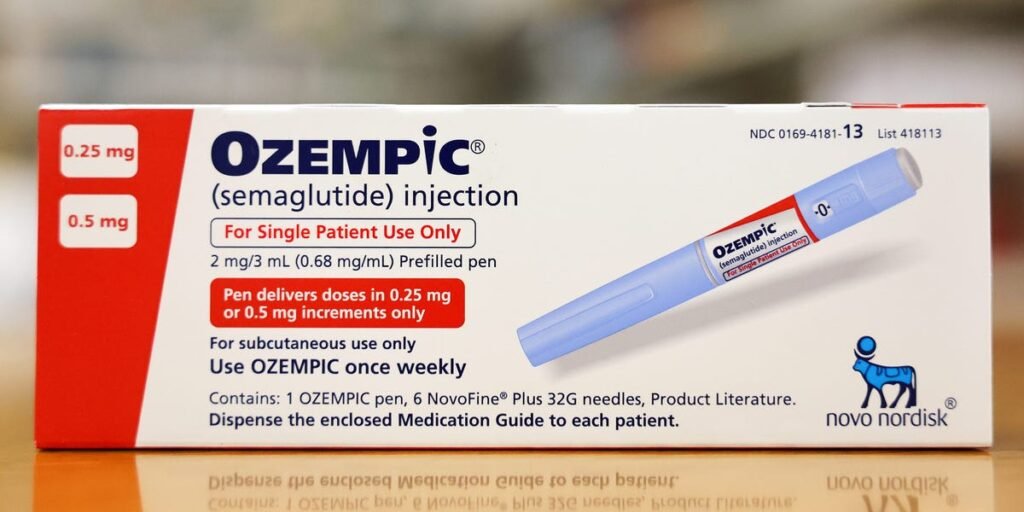

Ozempic has taken the world by storm thanks to how it can help people lose weight, but it could also mean so much more for the economy.

Ozempic is a brand name for semaglutide, a diabetes drug that also has weight loss effects. Patients inject it weekly, and it reduces appetite. Semaglutide is also sold for weight loss under the brand name Wegovy.

While it’s too early to know exactly how GLP-1 drugs’ will ripple out to the broader economy long-term, it’s already had significant effects on patients’ consumption, and companies are keeping an eye out for future developments.

“Over 40% of the country is living with obesity,” said Dan Kurland, senior equity analyst at asset management firm Columbia Threadneedle Investments, in a media call on March 19. “There are now effective drugs, and this could lead to higher labor productivity, gains in longevity, and potentially reduce medical costs costs elsewhere in the health system.”

Columbia Threadneedle Investments reported that the weight-loss drug industry could become a $1.7 trillion annual market if 100 million Americans took GLP-1s.

For comparison, the pain management drug industry — which includes antidepressants, opioids, acetaminophen, and ibuprofen — was worth $72.3 billion in 2022.

Weight-loss drugs are changing how much people spend on their health

The popularity of weight-loss drugs will likely impact consumer spending across industries.

Walmart, for example, which sells Ozempic and other GLP-1 drugs, found that customers buying those medications spent less on food year over year but more on lifestyle and fitness.

Nik Modi, a managing director at RBC Capital Markets who focuses on consumer goods, told Insider that this is a sign that people aren’t spending less. They are just buying different products.

“Consumers are looking for better-for-you products,” Modi said, adding that healthier products will be a big winner as consumers change their habits in this economy.

The effects could be much broader than food and healthcare. As Josh Barro recently wrote in his economics and business newsletter “Very Serious,” workers could be more productive because they live longer, healthier, and happier lives.

“Lower disease burden will mean fewer sick days and higher labor productivity,” Barro projects. “And there will be huge gains in personal happiness: well over a hundred million Americans who have been struggling all their lives to control their weight will be finally succeeding at it, and in a way that does not involve a great deal of mental effort or perceived sacrifice.”

This could increase people’s self-esteem, Barro posits, and could allow people to redirect energy and resources from dieting to other activities as well as change their consumption. Additionally, employee productivity could increase as Americans see the long-term benefits of weight loss and stay in the workforce longer.

Radical weight loss could change what people buy and affect companies’ bottom lines

Some businesses have already seen changes in consumer behavior due to GLP-1 drugs, which clinical trials have shown could help patients lose an average of 15% of their body weight over 68 weeks.

An August survey by Morgan Stanley of 300 people using GLP-1 drugs for weight loss found that 77% of respondents reported visiting fast-food restaurants “less frequently,” while 61% and 59% said the same about casual dining restaurants and coffee shops, respectively.

Meanwhile, GLP-1s could indirectly help other businesses, like airlines. A Jefferies Financial analyst used data from United Airlines and calculated that the company could save 27.6 million gallons of fuel per year, at a cost of $80 million, if the average passenger weighed 10 pounds less.

In addition, some patients have also noticed a reduced desire for alcohol, tobacco, and even opioids, suggesting these drugs could be used to treat addiction.

While GLP-1 drugs are not approved as addiction treatments, these observed side effects could boost the economy and workforce, Barro wrote.

“Ex-smokers work more than still-smokers because they are less burdened by disease and disability,” Barro wrote. “Presumably, they’re taking their earnings and spending more than they otherwise would have on non-cigarette products and services.”

The cost of GLP-1s is high, but it could have payoffs over time

To be sure, the drugs are expensive — as much as $1,000 per month for the diabetes drug Ozempic and even more for the weight-loss drug Wegovy. For people without diabetes, insurance coverage is still limited, companies are hesitant to provide it to employees, and people will likely need to be on them for life.

There is a risk that the rapid growth of weight-loss drugs could increase employer insurance premiums. Additionally, pharmacy benefit managers could make major profits: It only costs about $20 to manufacture a dose of Wegovy, Columbia Threadneedle found, and the drug retails for about $1,400.

The firm also reported that 44% of Americans would take a weight-loss drug if they were priced at $100 a month. Only 5% of Americans are willing or able to spend the current $1,000 monthly price out-of-pocket.

“There’s a huge demand for this category,” said Larry Lin, senior equity analyst at Columbia Threadneedle Investments. “Over time, prices will come down and make these products more accessible for others.”

Given all the medical advances it would seem likely that weight-loss drugs allow people will live longer and healthier. And, this individual impact is good for the economy.

Increased health and longevity could put more money in people’s pockets through things like lower healthcare costs, insurance premiums, groceries, and fewer trips to restaurants, in addition to potentially earning more over their lifetimes by staying in the workforce longer.

Type 2 diabetics who benefit from GLP-1s are also likely to spend less money on insulin, insulin pumps, and continuous glucose monitors, per Columbia Threadneedle Investments.

James van Geelen of Citrinitas Capital recently compared the obesity epidemic to the COVID crisis on Bloomberg’s “Odd Lots” podcast and discussed how to make weight-loss drugs more readily available.

“Why shouldn’t the government pay for this?” van Geelen said, noting that COVID vaccines were made available for free.

While obesity doesn’t cause a lockdown like COVID, treating it could save lives and have massive benefits to the economy and the country.

“I would say they are probably comparable public health crises,” van Geelen said. “If [the drug companies are] effective in proving that the side effects are moderate and that the overall benefit is sustained and is good, why would the government not cover it? If they’ll cover COVID vaccines, then they should probably cover this too.”

Are you currently taking weight-loss drugs? Are you open to sharing how you are affording them, and how the drug has impacted your expenses? If so, reach out to allisonkelly@insider.com.

This story was originally published in November 2023.

Read the full article here