Cybersecurity has become an integral component in today’s digitally connected world. It’s so significant that when CrowdStrike (NASDAQ: CRWD) accidentally released a software glitch to its cybersecurity platform, it caused a global tech outage on July 19.

CrowdStrike’s mistake can contribute to competitors capturing customers who may have otherwise considered the cybersecurity giant. SentinelOne (NYSE: S) is one such potential beneficiary. Its CEO, Tomer Weingarten, has called CrowdStrike his company’s “main competitor.”

SentinelOne shares ticked up after CrowdStrike’s tech blunder, suggesting investors believed it, indeed, could benefit. However, the company’s ability to perform over the long haul is a more important factor in an investment decision.

Here’s an analysis of SentinelOne to assess whether the company is a buy beyond the short-term boost gained from CrowdStrike’s error.

SentinelOne’s strong growth

Even if SentinelOne benefits from CrowdStrike’s mistake, it didn’t need the help. Before CrowdStrike caused a global outage, SentinelOne was already growing rapidly. Just how well its business is expanding is illustrated in its revenue numbers.

-

In SentinelOne’s fiscal first quarter, ended April 30, the firm achieved a 40% year-over-year sales increase to $186.4 million. According to SentinelOne management, this was driven largely by the acquisition of new customers.

-

Annualized recurring revenue (ARR) is another indicator of its success. SentinelOne generates sales by selling subscriptions to its cybersecurity capabilities, and ARR represents the income from these subscriptions over an annual period.

-

The number of SentinelOne customers spending ARR of $100,000 or more rose by 30% to 1,193 clients in Q1 from 917 in the prior year. Its customers with ARR greater than $1 million also hit a new company record in Q1.

SentinelOne’s AI technology

SentinelOne is attracting customers thanks to its AI-based cybersecurity technology. The company describes its AI platform as “Intelligent, data-driven systems that learn as they are challenged and evolve on their own.” Because SentinelOne’s tech can operate independently, it provides greater efficiency, simplicity, and cost savings to customers.

The company launched its AI cybersecurity tech back in 2013, long before today’s AI frenzy. According to SentinelOne, it was first in the world to design and build a cybersecurity platform with AI as its foundation.

The firm’s technology uses multiple layers of AI that can seamlessly integrate a customer’s existing cybersecurity products from other vendors into SentinelOne’s system. This reduces a customer’s switching costs and eliminates downtime when transitioning to SentinelOne, a selling point that helps the company win clients.

The company’s platform also takes a unique approach to cybersecurity, employing a software engine that mimics attacks to proactively look for weak areas in a customer’s defenses. According to SentinelOne management, no other competitor uses this approach.

Other factors to consider with SentinelOne stock

The cybersecurity company’s success in capturing customers has translated into strong financials.

-

SentinelOne reached positive free cash flow (FCF) for the first time in Q1. FCF hit $33.8 million in the quarter.

-

It exited Q1 with a strong balance sheet. Assets totaled $2.3 billion versus total liabilities of $694.1 million.

-

Those liabilities included deferred revenue of $493.1 million, which will eventually be recognized as income.

-

-

In addition, the company expanded its Q1 gross margin to 73% versus 68% in the prior year.

Yet despite its financial strength in many areas, SentinelOne isn’t profitable. It ended Q1 with a net loss of $70.1 million.

But this isn’t cause for concern. It’s common for high-growth tech companies to sacrifice profit in favor of investing in their business to increase sales.

Moreover, the company is moving toward profitability. Its $70.1 million loss in Q1 is a reduction from the prior year’s net loss of $106.9 million.

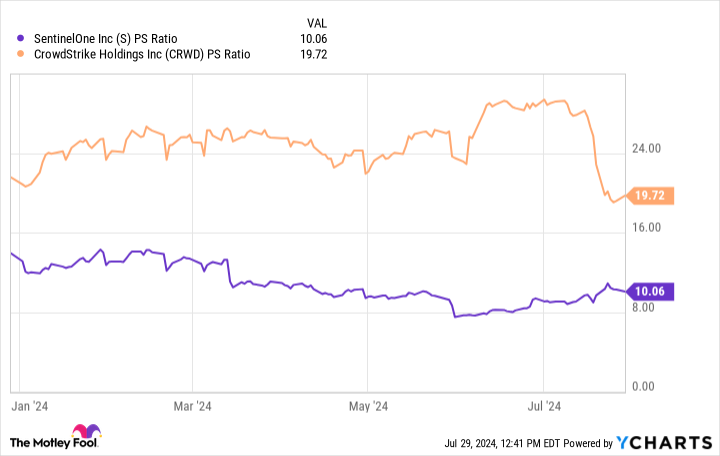

Another consideration is SentinelOne stock’s valuation. Let’s compare it to CrowdStrike using the price-to-sales (P/S) ratio, since SentinelOne’s lack of profitability means the price-to-earnings (P/E) ratio commonly used for stock valuation isn’t applicable.

SentinelOne’s substantially lower P/S ratio indicates it’s a better value, even after CrowdStrike’s share price dropped after the July 19 outage.

This, combined with SentinelOne’s superb revenue growth, AI-based technology, strong financials such as its transition to positive FCF, and its progress toward profitability, makes the firm a worthwhile long-term investment in the cybersecurity space.

Should you invest $1,000 in SentinelOne right now?

Before you buy stock in SentinelOne, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SentinelOne wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $717,050!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 29, 2024

Robert Izquierdo has positions in CrowdStrike and SentinelOne. The Motley Fool has positions in and recommends CrowdStrike. The Motley Fool has a disclosure policy.

Is SentinelOne Stock a Buy After Rival CrowdStrike Caused a Global Tech Outage? was originally published by The Motley Fool

Read the full article here