If you’ve been feeling down despite the apparent strength of the economy, I can relate. Despite stocks and real estate reaching near all-time highs, there seems to be a growing silent recession among Americans.

Here are the primary reasons why I believe some of us don’t feel better despite the apparent strength of the U.S. economy:

- The cost of living is rising, seemingly outpacing our incomes.

- Not everyone owns stocks, real estate, and other risk assets. And even if they do, their holdings may not be sufficient to offset the impact of rising prices across the board.

- Companies are achieving greater productivity with fewer employees, resulting in layoffs and a workforce that feels overburdened.

- Economic gains are disproportionately benefiting the wealthy, exacerbating income inequality.

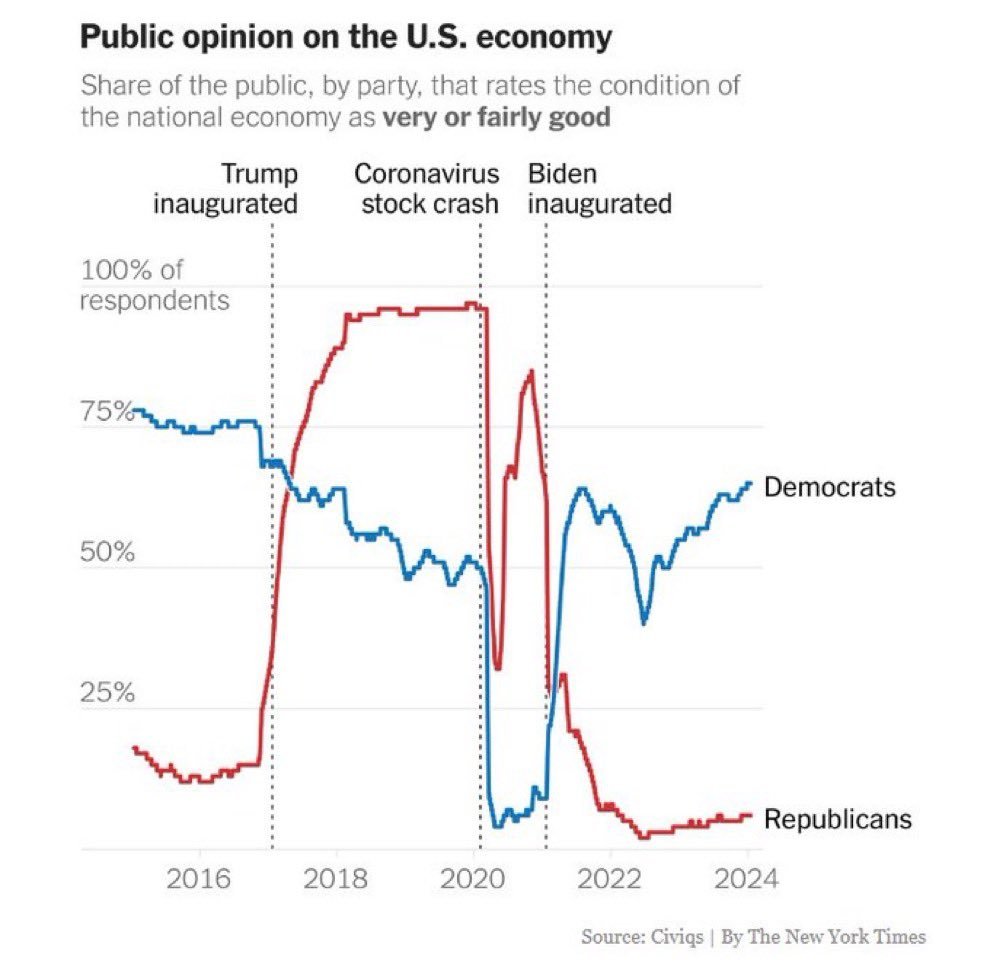

- You’re in a different political party than the President

I wanted to share some personal thoughts on my own situation and also delve into the broader economic landscape. Don’t forget to answer the one-question poll and share your thoughts in the comments below.

Silent Recession Due To Cost Explosion

As soon as I drained my liquidity to purchase my house, a slew of unexpected expenses arose. Here’s a breakdown of the unforeseen costs incurred in the first quarter of 2024 alone:

- $1,090 to replace a faulty vacuum pump and PVC valve in my car.

- $220 for an oil change (compared to $150 in June 2023).

- $1,200 for an emergency room visit for our daughter after our son accidentally dislocated her elbow.

- $890 for two new tires due to a collision from a mom trying to park during school drop-off, despite ample space.

- $900 for a new dishwasher in a rental property due to a faulty door latch.

- $2,100 for a new washer and dryer in another rental because the dryer stopped functioning and the washer lacks compatibility for stacking.

- $300 for repairing shingles blown off the roof during a severe storm.

- $200 for purchasing new landscaping rocks following city disruption of a landscaping project my children and I diligently worked on last summer.

The accumulation of these unexpected expenses has left us feeling like we’re living paycheck-to-paycheck, constantly bracing for the next unforeseen financial burden.

While our investments may be appreciating, their value remains abstract until we decide to sell. In contrast, these expenses are tangible and require immediate payment.

Families Are Feeling The Brunt Of Inflation The Most

Below is an insightful chart illustrating the price changes of various goods and services since January 2000, with the baseline overall inflation number standing at 82.4%, according to the Bureau of Labor Statistics.

However, if you have a family, you’re likely feeling the pinch more acutely. This is because you may be aspiring to buy a house and save for college, both significant financial commitments. We’ve been aggressively saving for my son’s college since he was born in 2017 and I still don’t think what we’ve saved in a 529 plan is enough.

With more individuals under your roof, there’s an increased likelihood of requiring hospital and medical services. Additionally, with more mouths to feed, your food and beverage budget naturally expands.

Each trip to the grocery store now results in a final bill that always surprises me in a bad way. Consequently, we’re actively working to eliminate as many covert expenses as possible from our budget.

Solutions To Cost Inflation

The main solutions to cost inflation are:

- Save up at least 3-to-6 months for an emergency fund to withstand unexpected financial surprises

- Keep your greed and desires to a minimum

- Have fewer kids or no kids to save money and energy

- Invest regularly and often

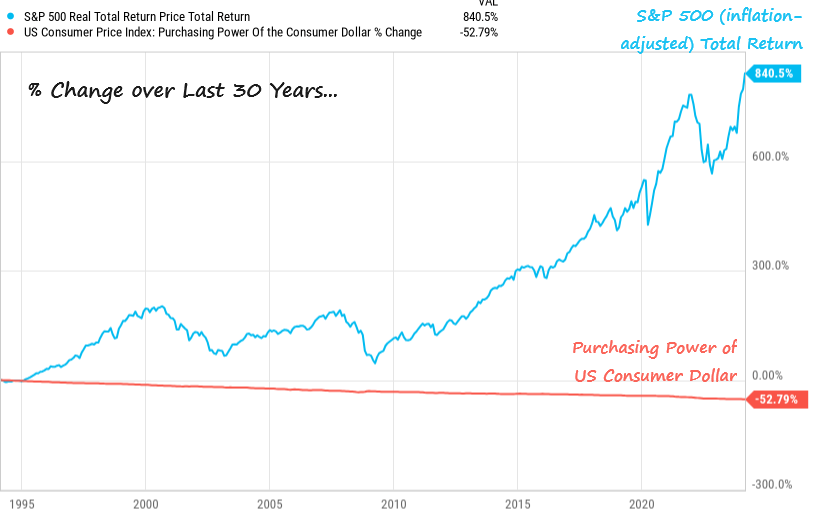

Below is an insightful chart demonstrating a 52.79% decline in the purchasing power of the U.S. dollar over 30 years. Simultaneously, the S&P 500 real total return has surged by 840.5% during the same timeframe. Investing is a must if you want to overcome inflation.

Feels Like A Silent Recession Because Not Everybody Owns A Home

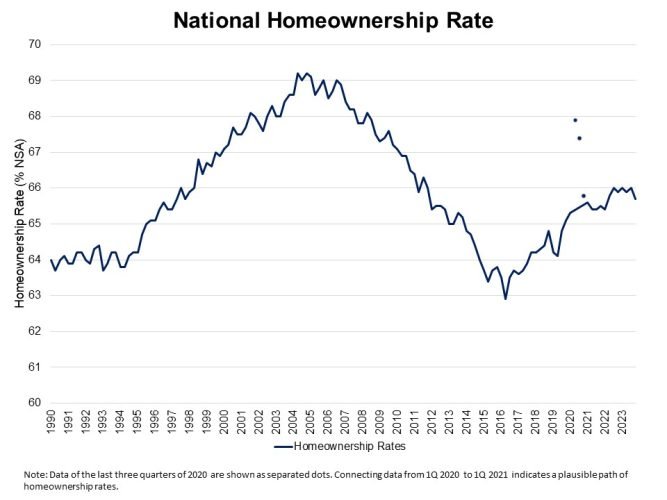

The national homeownership rate stands at approximately 65%. Consequently, around 35% of Americans are not partaking in the housing bull market. In fact, starting in 2023, there has been a decline in the national homeownership rate attributed to the surge in mortgage rates.

Imagine if one out of every three people you see walking down the street were undead zombies—you’d never leave your house!

Not only have real estate prices largely increased since the pandemic began in 2020, but so have rents. Consequently, a significant portion of the population is not feeling optimistic about rising home prices; they may be feeling downright distraught.

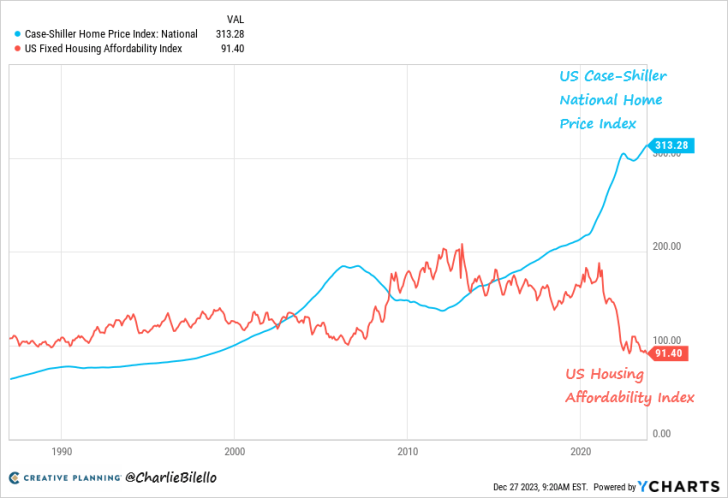

Consider this: if the national median home price is approximately $420,000, a 5% increase in the median home price would necessitate a 28% increase in the median household income of $76,000 just to break even. Unfortunately, the average American household does not receive anywhere near a 28% raise every year.

In some cities, the median home price has increased by far more than 5% per year since 2020, requiring an even greater increase in wages to afford a median-priced home. Ironically, the unhappiest cities in America may very well be the ones where real estate prices have increased the most.

Some Of The Angriest People Online Are Renters

I’ve been writing about real estate on Financial Samurai since 2009, and let me tell you, some of the angriest commenters on my real estate posts are renters. Read the comments in posts such as:

But it’s not just the opinionated posts where I recommend readers get neutral real estate that attract angry comments from renters. Even neutral posts like “Real Estate Or Stocks: Which Is A Better Investment?” can provoke heated responses.

Conversely, you see much fewer heated comments from homeowners online since 2009. They don’t need to justify their decision to own because they’re too busy getting on with their lives while prices inch higher.

Denial About Real Estate Performance Is Unhealthy

If you spend any time on social media or in real estate forums, you’ll also notice many of the angriest voices come from renters. They dislike homeowners and any government policy that promotes homeownership, such as the $250,000 / $500,000 tax-free profit rule on a home sale. I completely understand their frustration.

There are even personal finance bloggers who could have purchased property in 2012 but chose not to, or even sold their homes at that time to advocate for investing solely in stocks. That’s fine, as I also strongly believe in owning stocks for the long run. Dividend stocks become a more attractive passive income source the older and wealthier you get.

However, the way some renters criticize homeownership and anyone who invests in real estate, despite the surge in real estate prices since 2012, is absurd. So is the inability to admit that selling or not buying a home in 2012 was a suboptimal move.

Considering that everyone needs a place to live, while not everyone needs to invest in stocks, the escalating price of real estate is a significant factor contributing to the silent recession or “vibecession.”

Percentage Of Renters By City

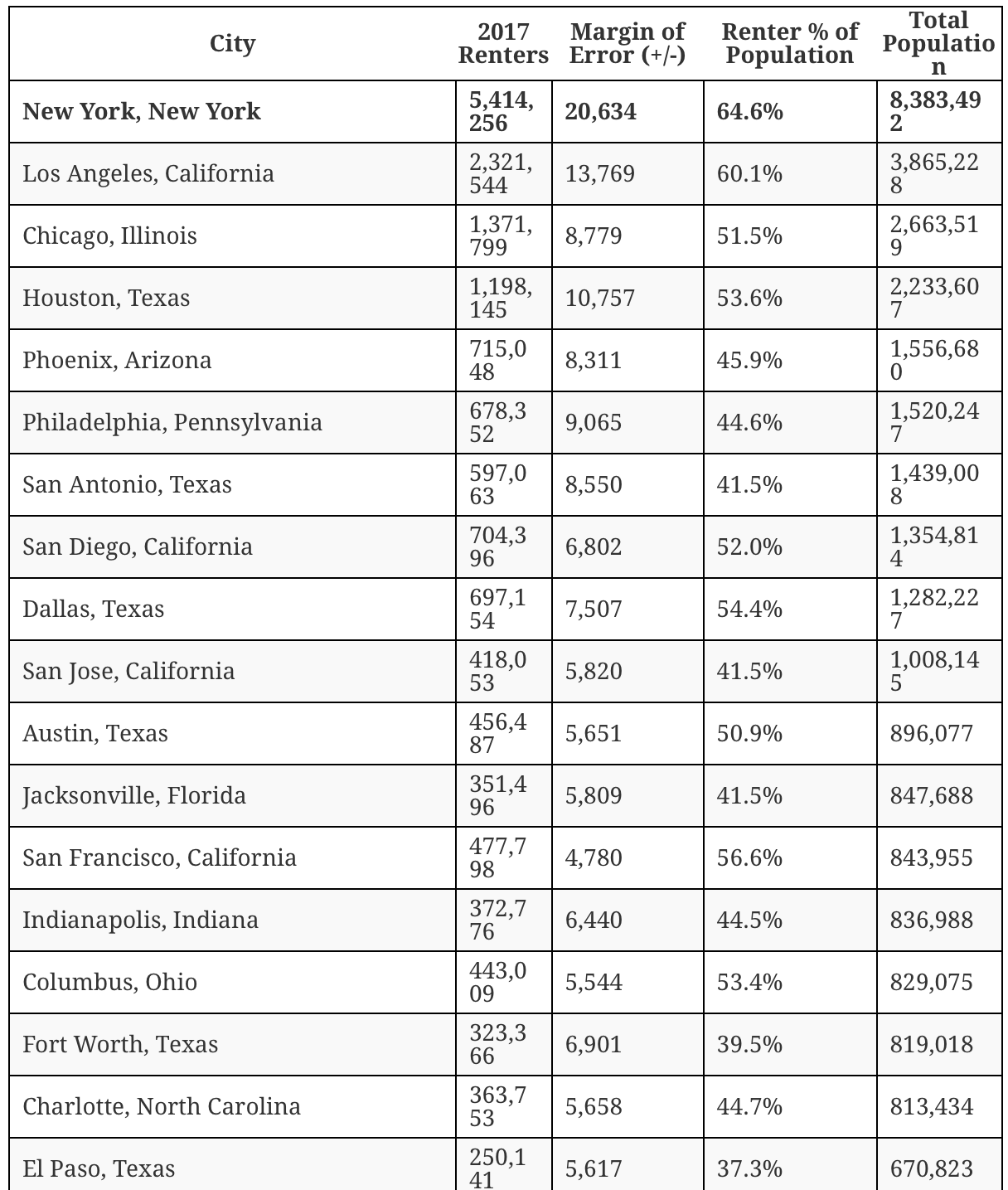

Here’s an interesting chart I found from Governing.com, which shows the percentage of renters by city. To no surprise, New York, New York has the highest renter percentage of population given New York is the most expensive city in America.

However, what’s shocking is that Chicago, Illinois (51.5% renters), Houston, Texas (53.6% renters), and Columbus, Ohio (53.4% renters), three of the most affordable cities in America, also have a greater renter population than owner population. If I were a renter in one of these cities and desired to own a home, I’d feel somewhat agitated.

To no surprise, Chicago and Houston are two of the unhappiest cities in America based on my Wealth Reality Ratio. You can learn more about my formula and reasoning by clicking on the graph below.

Columbus would also be classified as an unhappy city using my methodology since the median home price is so low ($275K), yet the net worth required to feel wealthy is so high (in the millions).

The Federal Reserve Is Hurting Renters Who Want To Own

If you’re a renter you probably hate the Federal Reserve. Not only is the cost of everything continuing to go up after 11 rate hikes, the Federal Reserve has also made homeownership even more unaffordable due to high mortgage rates.

The only people who can afford to buy homes are those with greater financial means. After the global financial crisis, banks stopped lending to everyone except for those with the largest down payments, highest incomes, and the highest credit scores. As a result, the wealthiest people were able to buy the most number of properties for cheap making them even more wealthy.

Today, the wealthiest people are able to buy homes at discounts because they face less competition due to higher mortgage rates. If and when mortgage rates come down, there will be a return of bidding wars where less wealthy people miss out.

The Fed Governors are all rich. Chairman Jerome Powell is easily worth over $100 million. When the majority doesn’t think the Fed or the federal government are on their side, no wonder why people might feel like it’s closer to a recession than a bull market.

Solutions To Rising Home Prices Hurting Your Happiness

If you’re a renter feeling uneasy about not owning property, one solution is to invest in real estate online. This involves purchasing a real estate ETF, a public REIT, or investing in private real estate funds.

Investing in real estate online eliminates the need for a large down payment and a mortgage. You can simply buy a single share of an ETF or REIT, or opt to dollar-cost average into a real estate fund like those offered by Fundrise.

By investing in real estate online, you can benefit if the real estate market rises, reducing the sense of being left behind. Conversely, if the market declines, your losses are likely to be less significant compared to the overall cost of purchasing a house, given the smaller scale of your investment.

Silent Recession Due To Company Layoffs

After Elon Musk acquired Twitter on April 14, 2022, he proceeded to lay off approximately 80% of its employees. Two years later, Twitter is still operational. While the site may have its share of bugs, it continues to function more or less the same.

Elon’s cost-cutting measures likely influenced the hiring decisions of many leaders at other tech companies. CEOs of companies like Apple, Meta, and Google, along with others, may have thought, “If Twitter can reduce its workforce and still remain productive, perhaps we should do the same.” Consequently, many big tech companies followed suit in 2023.

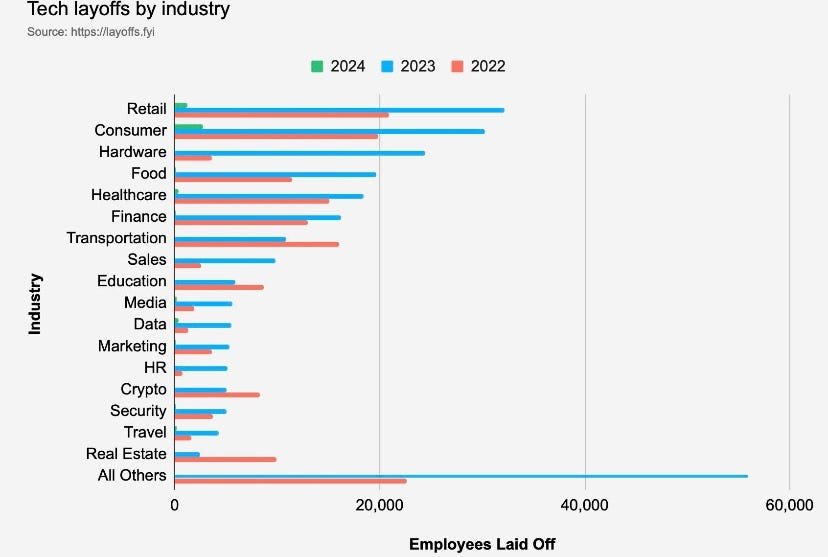

Here’s a chart illustrating tech layoffs by industry. It’s important to compare the 2023 (blue) figures to the 2022 (orange) figures, given that we’re still early in 2024.

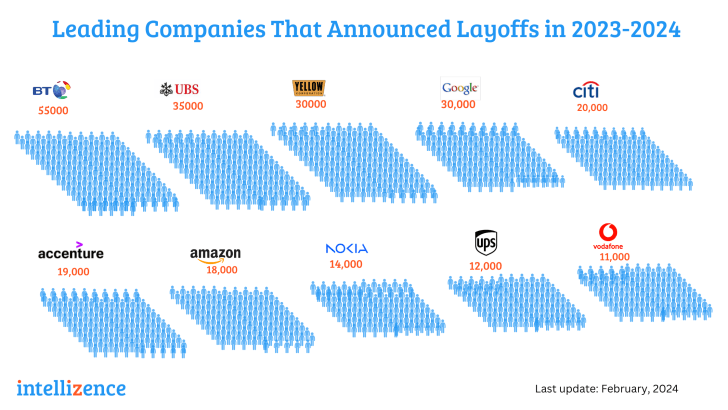

Here’s another chart displaying layoffs at specific large companies across sectors in 2023 and the data for 2024 so far. Continuous reports of major companies downsizing can naturally lead to increased uncertainty about job security.

I’ve come across numerous reports of job seekers sending out hundreds of resumes online without much success. Even with personal referrals, individuals are finding it increasingly difficult to land positions, as companies are growing more selective in their hiring processes.

For instance, I have a friend who is 29 years old with a solid degree and expertise in data analysis. Despite his qualifications, he’s been unemployed for 1.3 years. What anecdotes have you encountered regarding the labor market?

Artificial Intelligence: The Boogeyman

Another significant concern is artificial intelligence (AI). If you’re not allocating some portion of your capital to invest in AI companies, I believe you’re overlooking a crucial opportunity. AI serves as both a productivity enhancer for those who harness its capabilities and a job eliminator.

Take Klarna, for instance, a payment processing company valued at over $6 billion. It recently reported that its AI assistant handled two-thirds of its customer service requests within its first month of launch. Consequently, many of those customer service positions are likely to disappear.

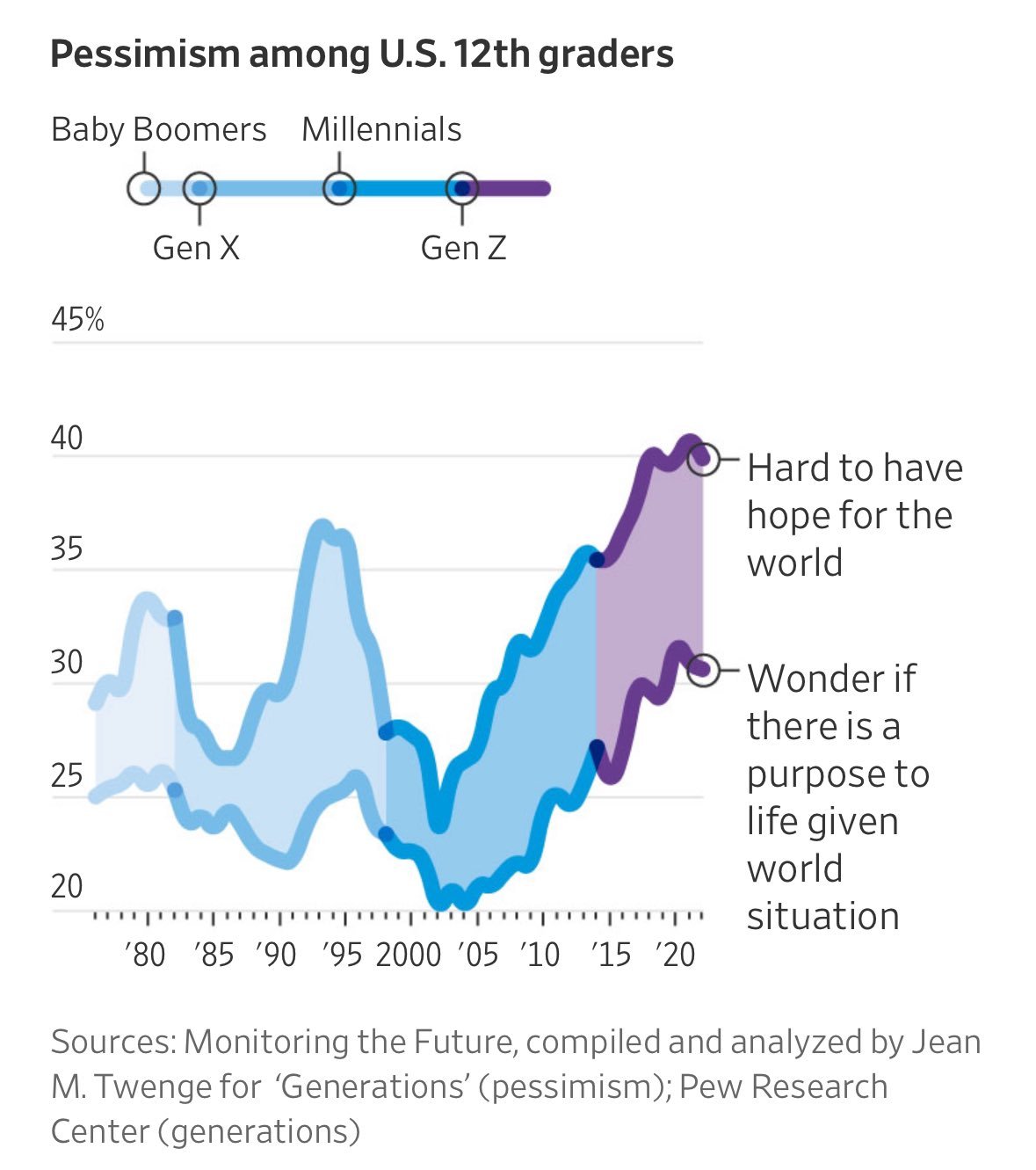

Looking ahead 20 years when my children will be entering the job market, it’s conceivable that there may be a 50% reduction in available jobs due to automation and AI. This sense of pessimism about the future is bound to weigh heavily on people’s minds.

Consider some of the questions students and parents may be grappling with, contributing to this silent recession.

- Why put in the effort to excel academically when there may not be any lucrative job prospects available?

- Why invest a fortune in college education when AI could render even computer engineering roles obsolete?

- With the wealth gap widening despite a booming market, what’s the point in striving for success if we’ll never catch up?

Solution To Company Layoffs Due To Efficiency And AI

Here are several solutions to protect yourself from company layoffs and AI:

- Become indispensable at work. Assess your value to the company – if your absence would significantly impact its operations, you’re on the right track. Otherwise, focus on taking on more valuable responsibilities and fostering stronger relationships. Going into the office if you are working remote. Remote workers are the easiest to layoff first.

- Diversify your active income streams by engaging in multiple side hustles. The more you can expand your side hustle income, the less vulnerable you’ll be to the effects of a layoff.

- If you anticipate layoffs, position yourself to be among the first to be let go. Typically, early layoff recipients receive more favorable severance packages than those laid off later. Keep tabs on your company’s health and research how previous laid-off employees were treated.

- Cultivate a strong personal or company brand. Aim to be perceived as intelligent, charismatic, team-oriented, solutions-driven, hardworking, or possessing other positive traits when people hear your name.

- Invest in big tech companies and private AI firms. If AI proves to be the revolutionary, job-displacing technology it’s often touted as, your portfolio of AI investments may thrive. If AI disappoints, then you and your children have a better chance at securing good jobs. Check out the Innovation Fund if you want to invest in private growth companies in AI and more. There’s only a $10 minimum versus a $100,000+ minimum for most venture capital firms.

A Silent Recession May Change The Course Of The Nation

If you’re a renter with children and feeling uncertain about your job prospects, chances are you’re not content with the current situation. Consequently, you may find yourself venting frustrations toward the current administration or engaging in heated online discussions with strangers.

It will be intriguing to observe whether President Biden secures re-election amidst the escalating negative sentiment surrounding the economy. With the unemployment rate projected to steadily rise throughout the year leading up to November, any delay in the Fed’s rate cuts followed by a potential stock market downturn could spell trouble for Biden’s tenure.

We might currently be experiencing a silent recession. However, if a traditional recession were to hit again, we must prepare for the worst. After all, the best time to build our financial reserves is when times are good, not when times are bad.

Reader Questions

Do you believe we’re experiencing a silent recession? How do you feel about the bullish stock market and the increasing cost of living? As a renter, how are you coping with rising home prices?

For those employed, are you growing concerned about job security? And for the unemployed, how long have you been without a job, and what’s the current job market like?

As for gauging any uptick in discontent within the comments section of Financial Samurai, I’ll provide updates in upcoming newsletters. With over 2,500 posts published since 2009, I have amassed a substantial catalog of content that can reflect the prevailing mood of the nation.

Read the full article here