Key takeaways

- Existing HELOC borrowers can expect their rates to decrease in response to a Fed rate cut, but it may take 1-2 statement cycles.

- A Fed rate cut won’t directly impact existing fixed-rate home equity loans, but it can lower the offers on new loans. So, current borrowers may want to consider refinancing to take advantage.

- Borrowers should carefully consider the costs and risks of tapping into their home equity through a HELOC or home equity loan, as rates remain relatively high and your home is collateral for the debt.

Four times in a row now, the Federal Reserve has left interest rates untouched, most recently opting not to change rates at its June meeting. That’s in contrast from last year, which saw three successive cuts — and a corresponding drop in home equity loan and home equity line of credit (HELOC) costs.

How does the Fed’s holding pattern affect you and your debts? If you already have a HELOC, can your rate still change? Is now a good time to take out a home equity loan? Should the Fed’s pause alter your feeling about borrowing against your home equity in general? Let’s break down what you need to know about tapping your equity today.

How does the Fed impact HELOCs and home equity loans?

When the Fed cuts interest rates, the impact on HELOCs and home equity loans can be immediate, but it varies, reflecting the different nature of these two forms of borrowing.

HELOCs typically have variable interest rates that are directly tied to the prime rate, which usually moves in tandem with the federal funds rate (the benchmark interest rate that the Fed adjusts). A change in the fed funds rate eventually hits your HELOC.

“When the prime rate drops, the interest rate on variable rate HELOC account balances will also drop by a similar amount, resulting in lower interest payments for the borrower,” says Charlie Wise, senior vice president and head of Global Research and consulting at TransUnion.

Keep in mind:

If you’ve frozen part or all of your HELOC balance — that is, converted it to a fixed interest rate, as some lenders let you do — it will not be affected by any changes in the fed funds or prime rates.

On the other hand, home equity loans typically have fixed rates, set when you take out the loan. If you currently have a home equity loan, it won’t be affected by any move the Fed makes. Of course, new home equity loans can, and do, reflect any rate changes: You might see the new numbers advertised within a few weeks.

Overall, of the two, HELOCs are more responsive to the central bank’s moves. Lenders usually offer better deals on new lines of credit following a Fed rate cut, while “existing HELOC borrowers will see their rates march lower at the same pace the Federal Reserve cuts benchmark interest rates,” says Greg McBride, chief financial analyst at Bankrate. “Historically, there has been less interest rate sensitivity on fixed-rate home equity loans when rates are falling. Borrowers seeking out home equity loans will need to shop around, as not all lenders will be reducing interest rates and certainly not at the same speed.”

How much could you save?

How much would a quarter-point rate drop (the size of the Fed’s December 2024 cut) save you? The exact amount will depend on the size of your loan or line of credit and its remaining term.

Let’s say you have a $100,000 HELOC balance and your current rate is 8.5 percent. With a quarter-point cut, your rate could drop to 8.25 percent, depending on how the terms of your loan are structured. That could save you almost $21 a month or almost $250 a year. That adds up to almost $5,000 over 20 years — the typical HELOC repayment term length. (We’re assuming your loan averages that rate for the entire length of time.)

It’ll happen fairly quickly, too.

“HELOC borrowers should see their rates move lower in response to any Fed rate cut, usually within one to two statement cycles, sometimes with a three-month lag,” McBride says.

Alternatively, say you’re considering a 20-year home equity loan in the amount of $100,000. Its rate has just dropped from 8.4 percent to 8.15 percent. That quarter-point cut could save you almost $16 a month or about $190 a year. That sounds small, but it adds up to more than $3,700 over the loan’s lifespan.

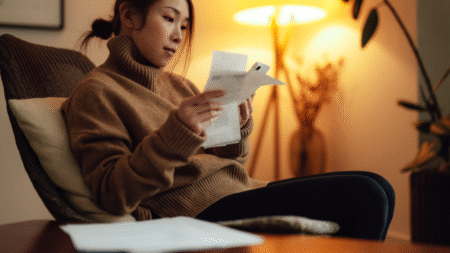

Should you tap your home equity now?

Regardless of what the Fed does —and it still has cuts in mind for 2025 — is this the opportune time to tap into housing wealth? The average mortgage-holding homeowner is sitting on nearly $300,000 in tappable equity, according to Cotality, which could be used for anything from reducing debt to investing to renovating.

“Obtaining a HELOC at this time is a great choice for homeowners as it allows them to tap into the equity in their home without affecting their existing lower mortgage rate,” says Sarah Rose, senior home equity manager at Affinity Federal Credit Union. “As rates continuously decline, so are the qualified rates on the variable-rate HELOC products. Lower rates equate to lower payments.”

It’s important to keep things in context, however. While lower than unsecured personal loans and credit cards, home equity loans and HELOCs are not super-cheap. As of mid-June, the average home equity loan rate is 8.25 percent, while the average HELOC rate is 8.27 percent. If you borrow a substantial, five-figure sum — the minimum that many lenders insist on — that interest can make your debt multiply fast.

Plus, that debt is backed by your home as collateral, so you could lose it if you can’t repay the loan or line of credit.

“It’s something that people who do not have savings, who are already in debt and don’t have regular flows of income have to really think hard about,” says Robert Frick, corporate economist at Navy Federal Credit Union. “Do I want to take on this extra risk? With a car loan, you will lose your car. You can normally get by without a car or borrow someone else’s car. You can’t borrow someone else’s home. So you have to think about your ability to repay.”

Where are home equity rates headed?

The Fed cuts last year caused home equity borrowing costs to drop. Despite this year’s pause, they’ve continued to get cheaper, according to Bankrate’s national survey of lenders. From a near-10 percent peak in September 2024, average HELOC rates have fallen nearly two percentage points to a two-year low. Home equity loan rates have also dropped, albeit more modestly. In fact, as of mid-June, the rates on both products are nearly the same, hovering around 8.25 percent.

Dramatic changes to home equity rates won’t happen overnight though, McBride says. “As the Fed cuts short-term interest rates and the prime rate falls, rates on existing HELOCs will stair-step downward in close concert,” he predicts. “Fixed-rate home equity loans will come down at a slower pace, but will also be susceptible to leveling out if longer-term Treasury yields stay elevated.

“That being said, the right product choice for you isn’t dependent solely on the rate but the particulars of how you need access to funds and handle repayment.”

A declining interest rate environment would seem to benefit variable-rate HELOCs over fixed-rate home equity loans — but there’s a chance your rate won’t drop below a certain threshold if you have a HELOC with an interest rate floor. Like a rate cap in reverse, this floor is the lowest rate you can be charged, no matter how much the HELOC’s benchmark index rate falls. It’s a way for lenders to make sure they don’t lose too much of that interest income when rates drop.

Some lenders give their HELOCs lifetime floors, while others reserve the right to change the floor based on current market conditions. Your loan agreement should spell out the terms.

“It varies lender to lender,” Frick says. “A fair lender will have a pretty low floor on the HELOC.”

That floor can move too. “Just because you took out a HELOC at one point, let’s say 2001 or 2002, it doesn’t mean the [same] terms still apply if you still have that same line of credit,” Frick says.

Should you refinance your home equity loan?

If you currently have a home equity loan, refinancing can make sense if interest rates have dropped significantly since you took out the loan. The general rule of thumb is to refinance only if you can reduce your interest rate by at least one percentage point, but in some cases, even half a point can make a big difference.

Not only can refinancing reduce your monthly payments, but it can lower the total interest paid over the life of the loan. Don’t forget, though: Refinancing isn’t free. Expect to pay some closing costs.

“If you have a home equity loan, it’s probably worthwhile to hang onto it until HELOC rates fall below your existing home equity rate,” Frick says. “Then you can think about refinancing to a HELOC — or you can refinance to another home equity loan, but that can be expensive.”

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Read the full article here