An annuity is a financial product that can provide a stream of guaranteed income in retirement. But buying an annuity isn’t always as straightforward as it seems.

With different types, rates and costs to consider, it’s easy to overlook key details. However, these simple mistakes can lock you into an annuity contract you don’t fully understand, potentially leading to lower payouts and higher fees.

Before you sign on the dotted line, it’s important to be informed. Here are five common mistakes people make when buying an annuity and how to avoid them.

5 common annuity mistakes to avoid

1. Not paying attention to fees

One of the biggest mistakes people make when buying an annuity is overlooking the fees. Annuities are often loaded with commissions and other charges that can eat into your returns over time. Some common fees include:

- Administrative fees: This covers the cost of managing the annuity.

- Mortality and expense risk charges: Insurance companies charge this fee for guarantees provided in the annuity contract.

- Rider fees: These are associated with optional add-ons like death benefits or guaranteed income riders.

- Surrender charges: Penalties for withdrawing money early.

These fees can add up quickly, especially with variable annuities. Meanwhile, other types of annuities, such as single-premium immediate annuities and multi-year guaranteed annuities, tend to be simpler options with fewer costs.

Always request a breakdown of all costs associated with the annuity and ask how these expenses impact your overall returns.

By doing a little research, you may be able to find a lower-cost product that meets your needs without compromising on the benefits you want.

2. Not shopping around

The annuity marketplace isn’t known for its transparency, so it’s essential to shop around to find the best product. Taking the time to compare quotes can mean better payouts, lower costs and more confidence that you’re making the right decision for your retirement plan.

Shopping around is so important because rates and features vary widely between providers. Plus, some annuity companies have stronger financial ratings than others, which can affect the insurer’s ability to make good on those guaranteed payouts long term.

Comparing immediate annuities is relatively straightforward — simply look at how much income you’ll receive each year based on your age and chosen payout type (e.g., life only or joint life) for the amount you invest.

Numerous online marketplaces, like Immediate Solutions, allow you to compare quotes from top-rated insurers side by side without entering a phone number.

You can also consult a trusted third-party financial advisor to help you vet different offers or work with an insurance broker to gather quotes. For example, Charles Schwab’s immediate annuity marketplace includes eight insurers with a financial strength rating of A or better.

3. Not understanding the interest rate on your fixed annuity

Fixed annuities are popular for their predictable returns, but many buyers fail to fully understand how the interest rates work.

Most fixed annuity contracts offer both a minimum guaranteed interest rate and a higher current interest rate. The latter is often advertised to attract new customers.

For example, an annuity might have a current rate of 6 percent and a guaranteed minimum rate of 2.5 percent. However, the current rate can fluctuate — so what starts out as a 6 percent teaser rate in the first year might drop after that.

While some insurers try to maintain competitive rates over time based on performance and costs, others use the higher first-year rate as a temporary incentive.

Without realizing this, you might overestimate your long-term returns. So it’s important to ask questions about:

- Initial rates: How long is the introductory rate guaranteed?

- Minimum rates: What is the minimum guaranteed rate you can expect after the initial period ends? Does that rate reset every few years?

By understanding these details, you can avoid surprises down the road.

4. Not understanding surrender charges

Surrender charges are another area where annuity buyers can stumble. These penalties apply if you withdraw money from your annuity before the end of the surrender period, which usually lasts five to 10 years, depending on the contract.

Surrender charges typically start around 10 percent and decrease each year until the surrender period ends. That makes withdrawals much more expensive in year one than in year five. For example, with a seven-year surrender period, withdrawing in year two might incur a 10 percent penalty, while withdrawing in year six may only result in a 3 percent penalty.

Withdrawal rules vary by insurer and annuity type — immediate annuities rarely allow withdrawals, while deferred annuities may offer some access. Some contracts include a free withdrawal provision, letting you take out up to 10 percent of the annuity’s value annually without fees.

Before buying an annuity, make sure you:

- Understand the length of the surrender period.

- Know the specific penalty percentages for each year.

- Determine whether the annuity includes a free withdrawal provision and how much you’re allowed to withdraw penalty-free.

- Directly ask, “What will it cost to get all my money out?”

5. Not asking enough questions

Many buyers simply accept what’s presented to them by an insurance agent without digging deeper. Or they’re confronted with so much industry jargon, they don’t know which questions to ask.

Aside from cost, make sure to get clarity on anything in your annuity contract you don’t fully understand. If the agent or advisor can’t provide clear answers, sidesteps your questions or becomes annoyed, take it as a red flag and walk away. An advisor who dodges tough questions or gives vague responses may be more focused on earning commissions than serving your best interests.

Before making a long-term financial commitment, make sure you understand how the annuity works and whether it aligns with your needs.

Here are a few essential questions to ask:

- What type of annuity is this (fixed, variable, indexed, immediate or deferred)?

- Are there any guarantees, and what do they cover?

- How does inflation affect the payouts?

- Are there any additional riders, and what do they cost?

- What happens to the annuity if I pass away?

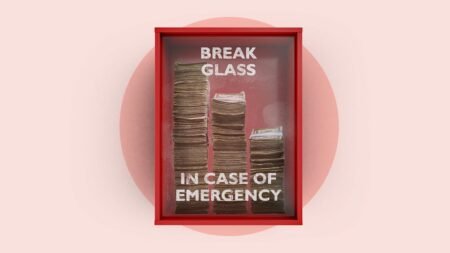

Bottom line

Annuities can provide reliable income in retirement but the devil is in the details. Take the time to compare fees, interest rates, surrender charges and other features before buying an annuity. Always ask questions — no matter how small — until you fully understand all the contract’s terms. Otherwise, a rushed decision could trap your money in an expensive, ineffective product that’s extremely difficult to get out of.

Read the full article here