Every year, as December rolls in and holiday lights start appearing on houses, a curious phenomenon shows up in the stock market: the Santa Claus rally. If you’re an investor, it’s the kind of quirky, seasonal pattern that’s worth understanding, both for context and for timing your year-end investment decisions.

So what is it, exactly? The Santa Claus rally refers to the tendency for the stock market, typically measured by the S&P 500, to post higher returns during the last five trading days of the year and the first two trading days of the new year. That said, as a strategic investor, you do not have to treat those dates as rigid boundaries.

Historically, it’s been a surprisingly consistent phenomenon. According to data going back decades, the S&P 500 has averaged a gain of roughly 1-1.5% during this period.

That might not sound like much, but in a market that struggles to move more than a few percent in a single week, it’s meaningful. And for long-term investors, knowing the historical context of these seasonal upticks can help temper expectations and reduce the urge to overtrade during the holidays.

Why Does A Santa Claus Rally Happen?

The Santa Claus rally doesn’t have a single, universally agreed-upon explanation, but several plausible theories have emerged over the years:

- Holiday Optimism: The end of the year is a time of cheer, bonuses, and positive sentiment. Investors may feel more confident and willing to buy stocks, which can lift prices. Unfortunately, for those who are FIRE, there is no paycheck or big year-end bonus to count on. So we’re counting on all of you to fund your IRAs, 401(ks), SEP-IRAs, and more!

- Tax-Loss Harvesting: Towards the end of December, investors often sell underperforming stocks to offset capital gains elsewhere. After this selling pressure eases, buying resumes, sometimes causing a bounce in stock prices.

- Portfolio Rebalancing: Many institutional investors and fund managers rebalance portfolios at year-end. This activity can create buying pressure in certain sectors, boosting overall market performance. This practice is often called window dressing: managers add well-performing stocks, sometimes late in the year or in small amounts, so they can showcase stronger holdings to their investors.

- Thin Trading: Holiday periods typically see lower trading volumes, which can exaggerate market movements up or down. Even modest buying interest can lead to noticeable price increases.

- Psychology and Expectation: Some argue the Santa Claus rally is, at least in part, a self-fulfilling prophecy. Traders and investors who anticipate a year-end lift may buy in advance, creating the rally itself.

Origins of the Term

The term Santa Claus rally was first popularized in the 1970s by Yale Hirsch, the founder of the Stock Trader’s Almanac. Hirsch noticed a recurring seasonal pattern and, with a wink toward the holiday season, dubbed it the Santa Claus rally. The phrase stuck because, like Santa, the market seems to deliver gifts at year-end, even if, in reality, it’s just a mix of psychology, technical factors, and historical quirks.

Since then, analysts have tracked the phenomenon closely. While the market doesn’t always deliver a rally, historical data shows it occurs often enough to merit attention.

Below is a chart highlighting the historical performance of the S&P 500 during the last five trading days of the year and first two trading days of the new year since 1950. What do you observe?

The Frequency Of A Santa Claus Rally

History shows that since 1950, the market has experienced a Santa Claus rally 77.33% of the time. Perhaps most interesting for this year, there has never been a stretch of three consecutive years without one.

During the ~23% of times the S&P 500 declines, it is due to factors like recessions, geopolitical crises, or major market shocks. But the long-term data suggests that, even with outliers, the odds tilt in favor of gains more often than not.

It’s also worth noting that the magnitude of the rally varies. Some years produce tiny gains; others see outsized jumps. For example, in periods following major market downturns, the Santa Claus rally has occasionally delivered mid-to-high single-digit percentage moves in just a few days, though these are the exceptions, not the rule.

Just look at what happened in 2008. The S&P 500 declined by 38.5% during the beginning of the global financial crisis. However, it saw a Santa Claus rally of 7.45%, followed by a 23.5% rebound in 2009.

How Investors Can Use This Knowledge

Understanding the Santa Claus rally isn’t about perfectly timing the market, which is impossible. It’s more about context, perspective, and making rational decisions:

- Don’t Panic: If your portfolio lags in December, remember that historical trends suggest a modest lift often arrives in the last week of the year.

- Mind Your Bias: Just because rallies happen frequently doesn’t mean they’re guaranteed. Treat this as a helpful historical pattern, not a crystal ball.

- Consider Rebalancing: Year-end can be an opportunity to rebalance portfolios or realize tax losses or get your asset allocation back to target. The Santa Claus rally is a bonus, but it shouldn’t dictate your core strategy.

- Confidence to Buy: If the market has already corrected, especially heading into the Santa Claus rally period, it can give you more confidence to put money to work.

While it doesn’t guarantee profits, understanding its patterns can help investors make calmer, more rational year-end decisions. It may also help avoid emotional trades during a season of thin trading volumes.

A Believer In This Year’s Santa Claus Rally

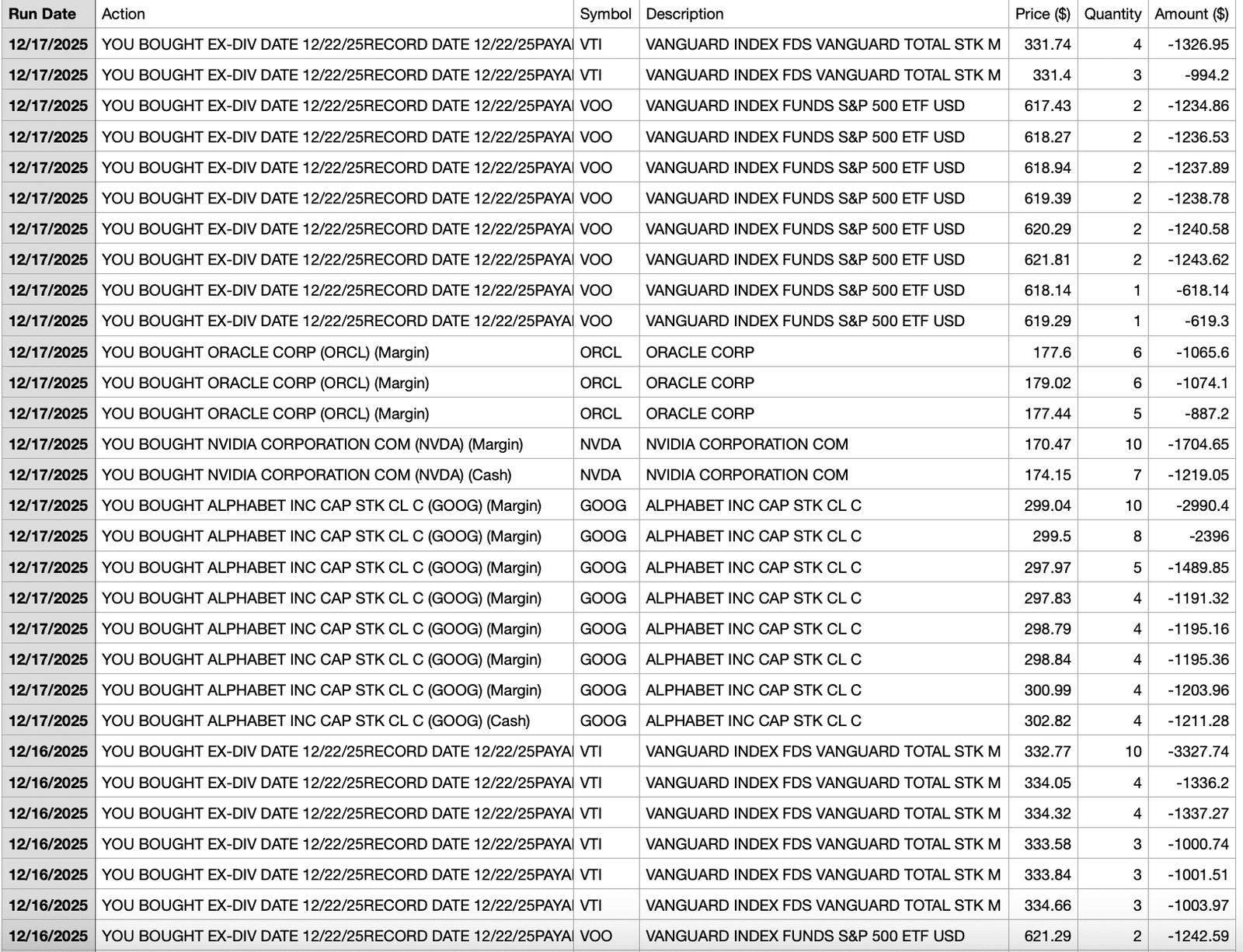

This year, I decided to act on the pattern. The S&P 500 went through roughly a 19% correction from February to April 2025, followed by another 6% drop from October to November. Then, on December 17, I bought the latest mini-dip, just as I did during the prior pullbacks, because I felt a Santa Claus rally or at least a rebound, was probable.

Given there has never been three consecutive years without a Santa Claus rally, it felt like we were due. The fact that the market delivered yet another mini-correction on December 17 felt like a gift for those waiting to put cash to work. Whether these investments ultimately prove profitable, only time will tell.

So much of investing is psychological. The more courage we have to invest consistently over the long term, the wealthier we tend to become. If understanding the Santa Claus rally helps us put money to work with greater confidence, then all the better.

Merry Christmas and happy holidays. May your investment portfolio give you the gift of big returns so you don’t have to work as hard in the new year!

Stay on Top of Your Finances This Holiday Season

Just like I took action during this year’s market dips heading into the Santa Claus rally, staying on top of your finances can give you an edge over the long term. One tool I’ve relied on since leaving my day job in 2012 is Empower’s free financial dashboard. It helps me track net worth, investment performance, and cash flow so I can make confident moves when opportunities appear.

If you haven’t reviewed your portfolio in the last six to twelve months, the end of the year is the perfect time. You can run a DIY checkup or schedule a complimentary financial review through Empower. Either way, you’ll uncover insights about your allocation, risk exposure, and investing habits that can help your long-term returns.

Investing consistently, tracking your finances, and acting when the time is right—like during market dips—lets small moves today compound into meaningful wealth tomorrow. Think of it as your own year-end gift to your future self.

Empower is a long-time affiliate partner of Financial Samurai. I’ve used their free tools since 2012 to track my finances. Click here to learn more.

If you enjoy stock market commentary and real-time insights into what I’m doing with my investments, you can subscribe to my free weekly newsletter here. I’ve been investing my own money since 1996 with the goal of generating positive returns and maximizing freedom.

Read the full article here